Page 13 - Estate Planning Documents

P. 13

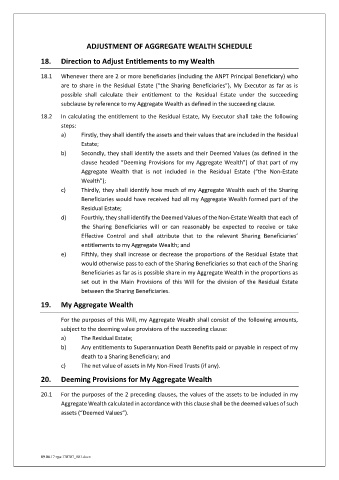

ADJUSTMENT OF AGGREGATE WEALTH SCHEDULE

18. Direction to Adjust Entitlements to my Wealth

18.1 Whenever there are 2 or more beneficiaries (including the ANPT Principal Beneficiary) who

are to share in the Residual Estate (“the Sharing Beneficiaries”), My Executor as far as is

possible shall calculate their entitlement to the Residual Estate under the succeeding

subclause by reference to my Aggregate Wealth as defined in the succeeding clause.

18.2 In calculating the entitlement to the Residual Estate, My Executor shall take the following

steps:

a) Firstly, they shall identify the assets and their values that are included in the Residual

Estate;

b) Secondly, they shall identify the assets and their Deemed Values (as defined in the

clause headed “Deeming Provisions for my Aggregate Wealth”) of that part of my

Aggregate Wealth that is not included in the Residual Estate (“the Non-Estate

Wealth”);

c) Thirdly, they shall identify how much of my Aggregate Wealth each of the Sharing

Beneficiaries would have received had all my Aggregate Wealth formed part of the

Residual Estate;

d) Fourthly, they shall identify the Deemed Values of the Non-Estate Wealth that each of

the Sharing Beneficiaries will or can reasonably be expected to receive or take

Effective Control and shall attribute that to the relevant Sharing Beneficiaries’

entitlements to my Aggregate Wealth; and

e) Fifthly, they shall increase or decrease the proportions of the Residual Estate that

would otherwise pass to each of the Sharing Beneficiaries so that each of the Sharing

Beneficiaries as far as is possible share in my Aggregate Wealth in the proportions as

set out in the Main Provisions of this Will for the division of the Residual Estate

between the Sharing Beneficiaries.

19. My Aggregate Wealth

For the purposes of this Will, my Aggregate Wealth shall consist of the following amounts,

subject to the deeming value provisions of the succeeding clause:

a) The Residual Estate;

b) Any entitlements to Superannuation Death Benefits paid or payable in respect of my

death to a Sharing Beneficiary; and

c) The net value of assets in My Non-Fixed Trusts (if any).

20. Deeming Provisions for My Aggregate Wealth

20.1 For the purposes of the 2 preceding clauses, the values of the assets to be included in my

Aggregate Wealth calculated in accordance with this clause shall be the deemed values of such

assets (“Deemed Values”).

09.06.17:rga:170707_001.docx