Page 16 - 1Q 2017 Reporter

P. 16

The League Helps Drive Record Turnout

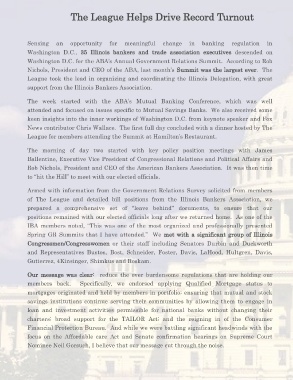

Sensing an opportunity for meaningful change in banking regulation in

Washington D.C., 35 Illinois bankers and trade association executives descended on

Washington D.C. for the ABA’s Annual Government Relations Summit. According to Rob

Nichols, President and CEO of the ABA, last month’s Summit was the largest ever. The

League took the lead in organizing and coordinating the Illinois Delegation, with great

support from the Illinois Bankers Association.

The week started with the ABA’s Mutual Banking Conference, which was well

attended and focused on issues specific to Mutual Savings Banks. We also received some

keen insights into the inner workings of Washington D.C. from keynote speaker and Fox

News contributor Chris Wallace. The first full day concluded with a dinner hosted by The

League for members attending the Summit at Hamilton’s Restaurant.

The morning of day two started with key policy position meetings with James

Ballentine, Executive Vice President of Congressional Relations and Political Affairs and

Rob Nichols, President and CEO of the American Bankers Association. It was then time

to “hit the Hill” to meet with our elected officials.

Armed with information from the Government Relations Survey solicited from members

of The League and detailed bill positions from the Illinois Bankers Association, we

prepared a comprehensive set of “leave behind” documents, to ensure that our

positions remained with our elected officials long after we returned home. As one of the

IBA members noted, “This was one of the most organized and professionally presented

Spring GR Summits that I have attended.” We met with a significant group of Illinois

Congressmen/Congresswomen or their staff including Senators Durbin and Duckworth

and Representatives Bustos, Bost, Schneider, Foster, Davis, LaHood, Hultgren, Davis,

Gutierrez, 4Kinsinger, Shimkus and Roskam.

Our message was clear: reduce the over burdensome regulations that are holding our

members back. Specifically, we endorsed applying Qualified Mortgage status to

mortgages originated and held by members in portfolio; ensuring that mutual and stock

savings institutions continue serving their communities by allowing them to engage in

loan and investment activities permissible for national banks without changing their

charters; broad support for the TAILOR Act; and the reigning in of the Consumer

Financial Protection Bureau. And while we were battling significant headwinds with the

focus on the Affordable care Act and Senate confirmation hearings on Supreme Court

Nominee Neil Gorsuch, I believe that our message cut through the noise.