Page 11 - 1Q 2017 Reporter

P. 11

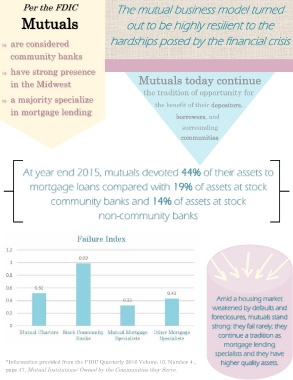

Per the FDIC The mutual business model turned

Mutuals out to be highly resilient to the

are considered hardships posed by the financial crisis

community banks

have strong presence

Mutuals today continue

in the Midwest

the tradition of opportunity for

a majority specialize

the benefit of their depositors,

in mortgage lending

borrowers, and

surrounding

communities

At year end 2015, mutuals devoted 44% of their assets to

mortgage loans compared with 19% of assets at stock

community banks and 14% of assets at stock

non-community banks

Amid a housing market

weakened by defaults and

foreclosures, mutuals stand

strong: they fail rarely; they

continue a tradition as

mortgage lending

specialists and they have

*Information provided from the FDIC Quarterly 2016 Volume 10, Number 4 , higher quality assets.

page 47, Mutual Institutions: Owned by the Communities they Serve.