Page 37 - Filing Status for Individuals - Handbook

P. 37

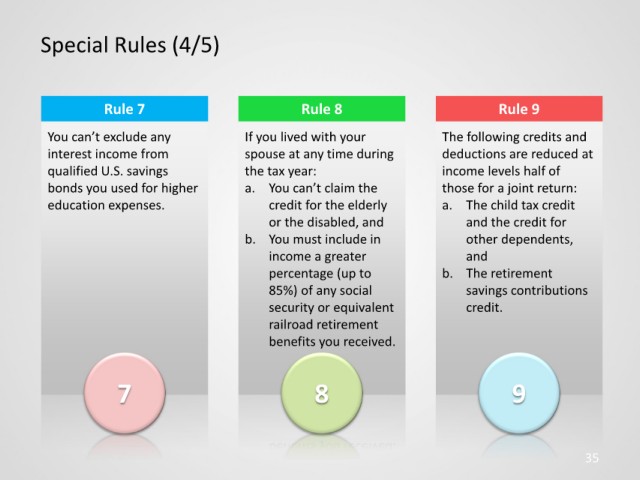

Special Rules (4/5)

Rule 7 Rule 8 Rule 9

You can’t exclude any If you lived with your The following credits and

interest income from spouse at any time during deductions are reduced at

qualified U.S. savings the tax year: income levels half of

bonds you used for higher a. You can’t claim the those for a joint return:

education expenses. credit for the elderly a. The child tax credit

or the disabled, and and the credit for

b. You must include in other dependents,

income a greater and

percentage (up to b. The retirement

85%) of any social savings contributions

security or equivalent credit.

railroad retirement

benefits you received.

7 8 9

35