Page 38 - Filing Status for Individuals - Handbook

P. 38

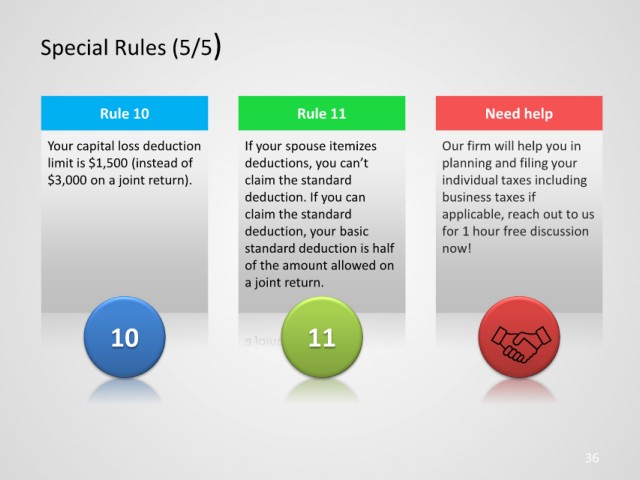

Special Rules (5/5)

Rule 10 Rule 11 Need help

Your capital loss deduction If your spouse itemizes Our firm will help you in

limit is $1,500 (instead of deductions, you can’t planning and filing your

$3,000 on a joint return). claim the standard individual taxes including

deduction. If you can business taxes if

claim the standard applicable, reach out to us

deduction, your basic for 1 hour free discussion

standard deduction is half now!

of the amount allowed on

a joint return.

10 11

36