Page 182 - Other Income for Individuals

P. 182

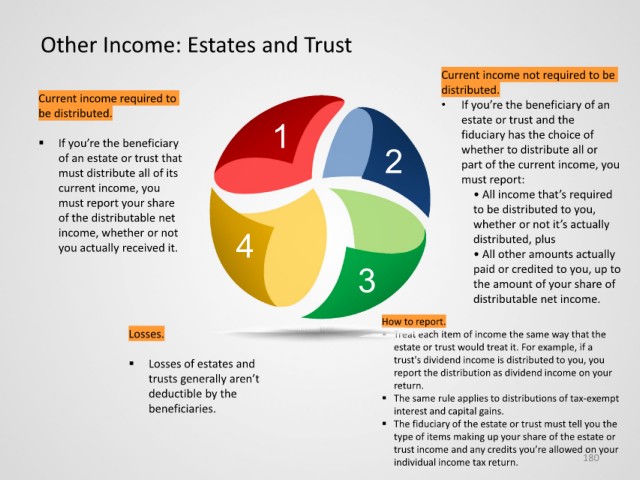

Other Income: Estates and Trust

Current income not required to be

distributed.

Current income required to • If you’re the beneficiary of an

be distributed. estate or trust and the

If you’re the beneficiary 1 fiduciary has the choice of

whether to distribute all or

of an estate or trust that 2 part of the current income, you

must distribute all of its must report:

current income, you • All income that’s required

must report your share to be distributed to you,

of the distributable net whether or not it’s actually

income, whether or not distributed, plus

you actually received it. 4 • All other amounts actually

3 paid or credited to you, up to

the amount of your share of

distributable net income.

How to report.

Losses. Treat each item of income the same way that the

estate or trust would treat it. For example, if a

Losses of estates and trust's dividend income is distributed to you, you

trusts generally aren’t report the distribution as dividend income on your

return.

deductible by the The same rule applies to distributions of tax-exempt

beneficiaries. interest and capital gains.

The fiduciary of the estate or trust must tell you the

type of items making up your share of the estate or

trust income and any credits you’re allowed on your

individual income tax return. 180