Page 191 - Other Income for Individuals

P. 191

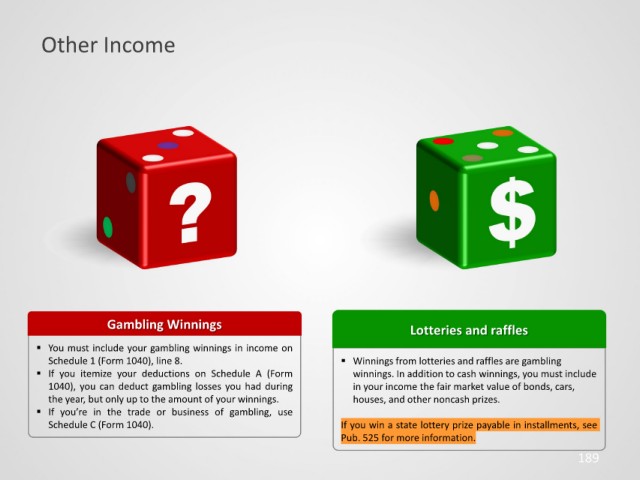

Other Income

Gambling Winnings Lotteries and raffles

You must include your gambling winnings in income on

Schedule 1 (Form 1040), line 8. Winnings from lotteries and raffles are gambling

If you itemize your deductions on Schedule A (Form winnings. In addition to cash winnings, you must include

1040), you can deduct gambling losses you had during in your income the fair market value of bonds, cars,

the year, but only up to the amount of your winnings. houses, and other noncash prizes.

If you’re in the trade or business of gambling, use

Schedule C (Form 1040). If you win a state lottery prize payable in installments, see

Pub. 525 for more information.

189