Page 661 - ACFE Fraud Reports 2009_2020

P. 661

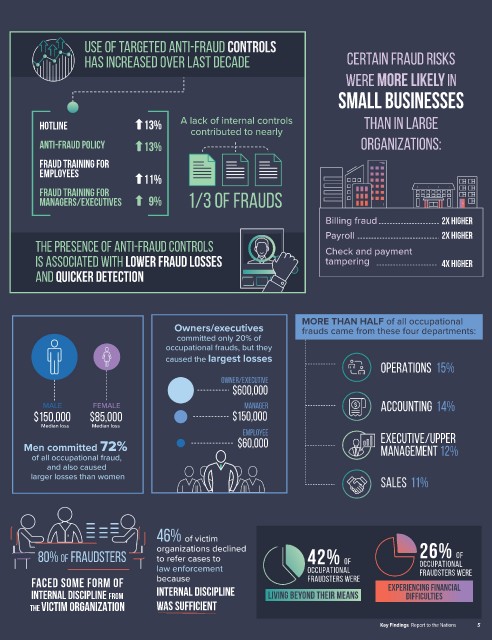

Use of targeted anti-fraud controls

has increased over last decade Certain fraud risks

were more likely in

small businesses

A lack of internal controls

Hotline contributed to nearly than in largE

Anti-fraud policy organizations:

Fraud training for

employees

Fraud training for

managers/executives 1/3 of frauds

Billing fraud 2X higher

Payroll 2X higher

The presence of anti-fraud controls Check and payment

is associated with lower fraud losses tampering 4X higher

and quicker detection

MORE THAN HALF of all occupational

Owners/executives frauds came from these four departments:

committed only 20% of

occupational frauds, but they

caused the largest losses

OPERATIONS 15%

Owner/Executive

$600,000

MALE FEMALE Manager ACCOUNTING 14%

$150,000 $85,000 $150,000

Median loss Median loss

Employee EXECUTIVE/UPPER

Men committed 72% $60,000 MANAGEMENT 12%

of all occupational fraud,

and also caused

larger losses than women

SALES 11%

46% of victim

organizations declined

80% of Fraudsters to refer cases to 42% OF 26% OF

law enforcement OCCUPATIONAL OCCUPATIONAL

FRAUDSTERS WERE

FACED SOME FORM OF because FRAUDSTERS WERE EXPERIENCING FINANCIAL

INTERNAL DISCIPLINE FROM INTERNAL DISCIPLINE LIVING BEYOND THEIR MEANS DIFFICULTIES

THE VICTIM ORGANIZATION WAS SUFFICIENT

Key Findings Report to the Nations 5