Page 5 - Texas Franchise Tax Handbook

P. 5

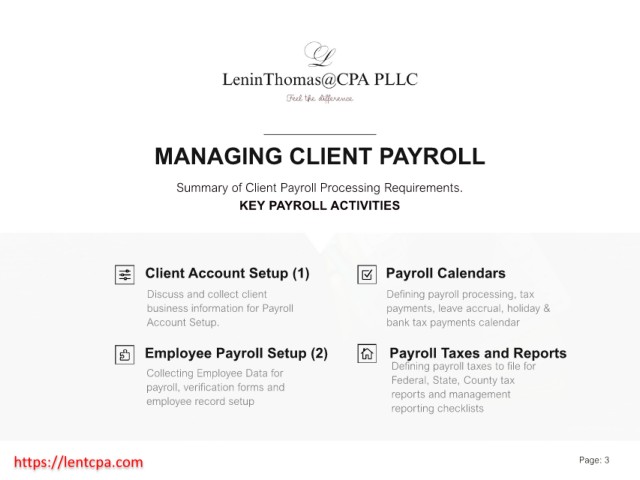

MANAGING CLIENT PAYROLL

Summary of Client Payroll Processing Requirements.

KEY PAYROLL ACTIVITIES

Client Account Setup (1) Payroll Calendars

Discuss and collect client Defining payroll processing, tax

business information for Payroll payments, leave accrual, holiday &

Account Setup. bank tax payments calendar

Employee Payroll Setup (2) Payroll Taxes and Reports

Defining payroll taxes to file for

Collecting Employee Data for Federal, State, County tax

payroll, verification forms and reports and management

employee record setup

reporting checklists

https://lentcpa.com Page: 3