Page 10 - Texas Franchise Tax Handbook

P. 10

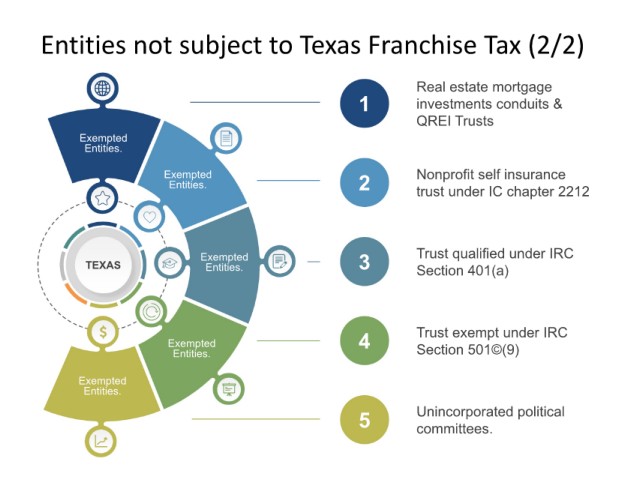

Entities not subject to Texas Franchise Tax (2/2)

Real estate mortgage

1 investments conduits &

QREI Trusts

Exempted

Entities.

Exempted Nonprofit self insurance

Entities. 2 trust under IC chapter 2212

Exempted 3 Trust qualified under IRC

TEXAS Entities. Section 401(a)

Exempted 4 Trust exempt under IRC

Entities. Section 501©(9)

Exempted

Entities.

5 Unincorporated political

committees.