Page 6 - Incorporatoin Services

P. 6

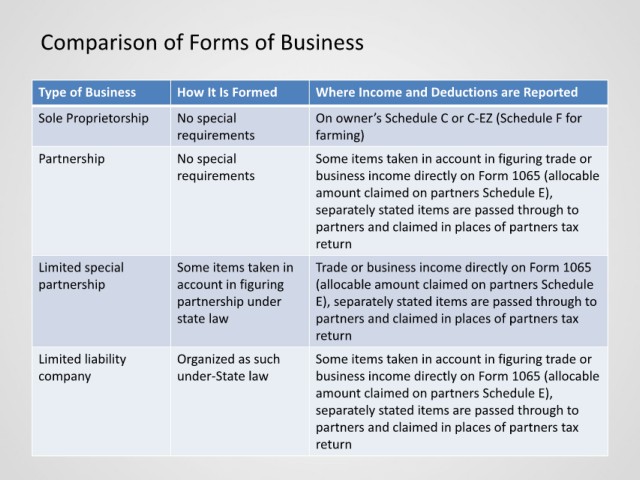

Comparison of Forms of Business

Type of Business How It Is Formed Where Income and Deductions are Reported

Sole Proprietorship No special On owner’s Schedule C or C-EZ (Schedule F for

requirements farming)

Partnership No special Some items taken in account in figuring trade or

requirements business income directly on Form 1065 (allocable

amount claimed on partners Schedule E),

separately stated items are passed through to

partners and claimed in places of partners tax

return

Limited special Some items taken in Trade or business income directly on Form 1065

partnership account in figuring (allocable amount claimed on partners Schedule

partnership under E), separately stated items are passed through to

state law partners and claimed in places of partners tax

return

Limited liability Organized as such Some items taken in account in figuring trade or

company under-State law business income directly on Form 1065 (allocable

amount claimed on partners Schedule E),

separately stated items are passed through to

partners and claimed in places of partners tax

return