Page 11 - Incorporatoin Services

P. 11

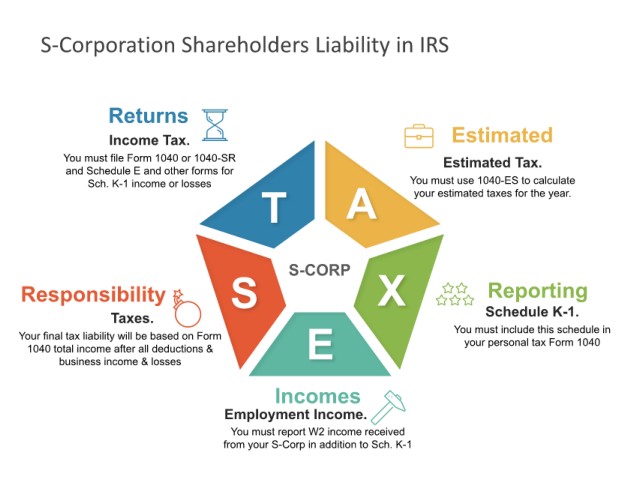

S-Corporation Shareholders Liability in IRS

Returns

Income Tax. Estimated

You must file Form 1040 or 1040-SR Estimated Tax.

and Schedule E and other forms for

Sch. K-1 income or losses You must use 1040-ES to calculate

T A

your estimated taxes for the year.

Responsibility S S-CORP X Reporting

Taxes. Schedule K-1.

Your final tax liability will be based on Form E You must include this schedule in

your personal tax Form 1040

1040 total income after all deductions &

business income & losses

Incomes

Employment Income.

You must report W2 income received

from your S-Corp in addition to Sch. K-1