Page 12 - Incorporatoin Services

P. 12

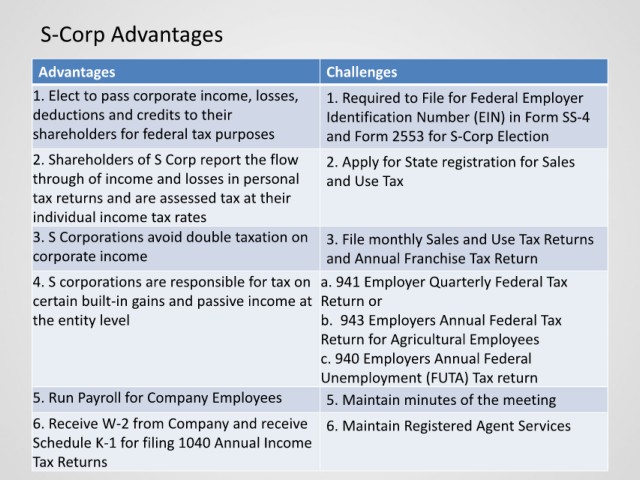

S-Corp Advantages

Advantages Challenges

1. Elect to pass corporate income, losses, 1. Required to File for Federal Employer

deductions and credits to their Identification Number (EIN) in Form SS-4

shareholders for federal tax purposes and Form 2553 for S-Corp Election

2. Shareholders of S Corp report the flow 2. Apply for State registration for Sales

through of income and losses in personal and Use Tax

tax returns and are assessed tax at their

individual income tax rates

3. S Corporations avoid double taxation on 3. File monthly Sales and Use Tax Returns

corporate income and Annual Franchise Tax Return

4. S corporations are responsible for tax on a. 941 Employer Quarterly Federal Tax

certain built-in gains and passive income at Return or

the entity level b. 943 Employers Annual Federal Tax

Return for Agricultural Employees

c. 940 Employers Annual Federal

Unemployment (FUTA) Tax return

5. Run Payroll for Company Employees 5. Maintain minutes of the meeting

6. Receive W-2 from Company and receive 6. Maintain Registered Agent Services

Schedule K-1 for filing 1040 Annual Income

Tax Returns