Page 17 - Incorporatoin Services

P. 17

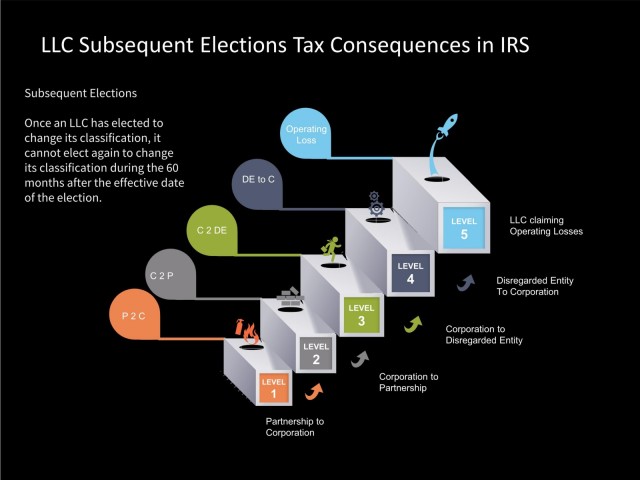

LLC Subsequent Elections Tax Consequences in IRS

Subsequent Elections

Once an LLC has elected to Operating

change its classification, it Loss

cannot elect again to change

its classification during the 60

months after the effective date DE to C

of the election.

LEVEL LLC claiming

C 2 DE 5 Operating Losses

LEVEL

C 2 P 4 Disregarded Entity

To Corporation

LEVEL

P 2 C 3

Corporation to

Disregarded Entity

LEVEL

2

Corporation to

LEVEL

1 Partnership

Partnership to

Corporation