Page 16 - Incorporatoin Services

P. 16

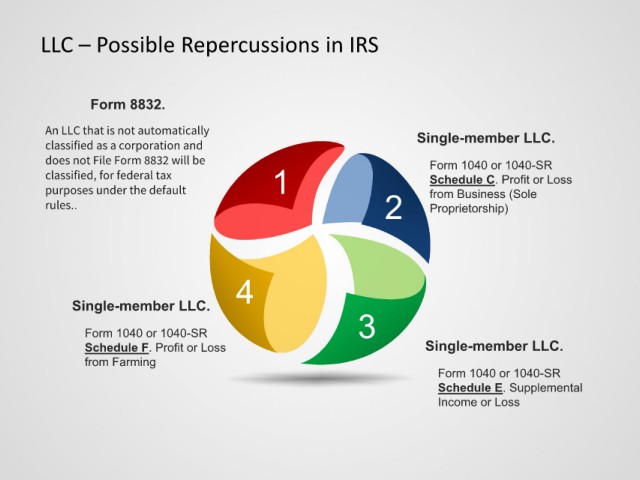

LLC – Possible Repercussions in IRS

Form 8832.

An LLC that is not automatically Single-member LLC.

classified as a corporation and

does not File Form 8832 will be Form 1040 or 1040-SR

classified, for federal tax 1 Schedule C. Profit or Loss

purposes under the default from Business (Sole

rules.. 2 Proprietorship)

4

Single-member LLC.

Form 1040 or 1040-SR 3

Schedule F. Profit or Loss Single-member LLC.

from Farming

Form 1040 or 1040-SR

Schedule E. Supplemental

Income or Loss