Page 18 - Incorporatoin Services

P. 18

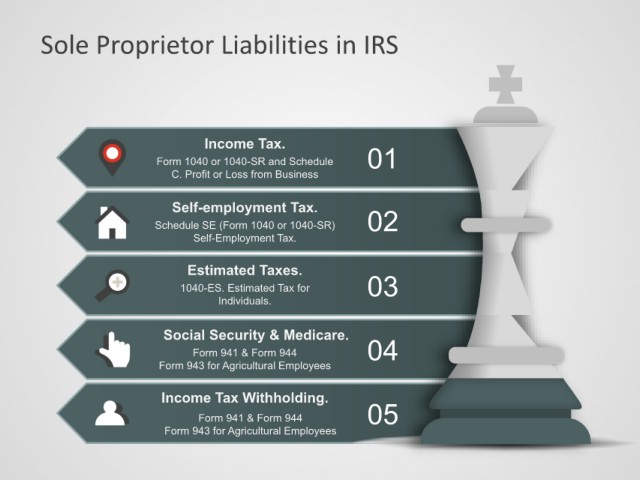

Sole Proprietor Liabilities in IRS

Income Tax.

Form 1040 or 1040-SR and Schedule 01

C. Profit or Loss from Business

Self-employment Tax.

Schedule SE (Form 1040 or 1040-SR) 02

Self-Employment Tax.

Estimated Taxes.

1040-ES. Estimated Tax for 03

Individuals.

Social Security & Medicare.

Form 941 & Form 944 04

Form 943 for Agricultural Employees

Income Tax Withholding.

Form 941 & Form 944 05

Form 943 for Agricultural Employees