Page 104 - 2020 Publication 17

P. 104

14:38 - 19-Jan-2021

Page 102 of 138 Fileid: … ations/P17/2020/A/XML/Cycle03/source

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

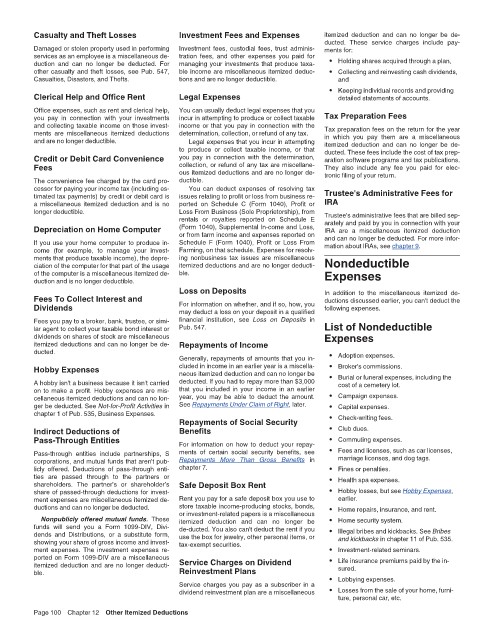

Casualty and Theft Losses Investment Fees and Expenses itemized deduction and can no longer be de-

ducted. These service charges include pay-

Damaged or stolen property used in performing Investment fees, custodial fees, trust adminis- ments for:

services as an employee is a miscellaneous de- tration fees, and other expenses you paid for

duction and can no longer be deducted. For managing your investments that produce taxa- • Holding shares acquired through a plan,

other casualty and theft losses, see Pub. 547, ble income are miscellaneous itemized deduc- • Collecting and reinvesting cash dividends,

Casualties, Disasters, and Thefts. tions and are no longer deductible. and

• Keeping individual records and providing

Clerical Help and Office Rent Legal Expenses detailed statements of accounts.

Office expenses, such as rent and clerical help, You can usually deduct legal expenses that you

you pay in connection with your investments incur in attempting to produce or collect taxable Tax Preparation Fees

and collecting taxable income on those invest- income or that you pay in connection with the Tax preparation fees on the return for the year

ments are miscellaneous itemized deductions determination, collection, or refund of any tax. in which you pay them are a miscellaneous

and are no longer deductible. Legal expenses that you incur in attempting itemized deduction and can no longer be de-

to produce or collect taxable income, or that ducted. These fees include the cost of tax prep-

Credit or Debit Card Convenience you pay in connection with the determination, aration software programs and tax publications.

Fees collection, or refund of any tax are miscellane- They also include any fee you paid for elec-

ous itemized deductions and are no longer de- tronic filing of your return.

The convenience fee charged by the card pro- ductible.

cessor for paying your income tax (including es- You can deduct expenses of resolving tax

timated tax payments) by credit or debit card is issues relating to profit or loss from business re- Trustee's Administrative Fees for

a miscellaneous itemized deduction and is no ported on Schedule C (Form 1040), Profit or IRA

longer deductible. Loss From Business (Sole Proprietorship), from Trustee's administrative fees that are billed sep-

rentals or royalties reported on Schedule E arately and paid by you in connection with your

Depreciation on Home Computer (Form 1040), Supplemental In-come and Loss, IRA are a miscellaneous itemized deduction

or from farm income and expenses reported on

If you use your home computer to produce in- Schedule F (Form 1040), Profit or Loss From and can no longer be deducted. For more infor-

mation about IRAs, see chapter 9.

come (for example, to manage your invest- Farming, on that schedule. Expenses for resolv-

ments that produce taxable income), the depre- ing nonbusiness tax issues are miscellaneous

itemized deductions and are no longer deducti- Nondeductible

ciation of the computer for that part of the usage

of the computer is a miscellaneous itemized de- ble. Expenses

duction and is no longer deductible.

Loss on Deposits In addition to the miscellaneous itemized de-

Fees To Collect Interest and ductions discussed earlier, you can't deduct the

Dividends For information on whether, and if so, how, you following expenses.

may deduct a loss on your deposit in a qualified

Fees you pay to a broker, bank, trustee, or simi- financial institution, see Loss on Deposits in

lar agent to collect your taxable bond interest or Pub. 547. List of Nondeductible

dividends on shares of stock are miscellaneous Expenses

itemized deductions and can no longer be de- Repayments of Income

ducted.

Generally, repayments of amounts that you in- • Adoption expenses.

Hobby Expenses cluded in income in an earlier year is a miscella- • Broker's commissions.

neous itemized deduction and can no longer be

A hobby isn't a business because it isn't carried deducted. If you had to repay more than $3,000 • Burial or funeral expenses, including the

cost of a cemetery lot.

on to make a profit. Hobby expenses are mis- that you included in your income in an earlier

cellaneous itemized deductions and can no lon- year, you may be able to deduct the amount. • Campaign expenses.

ger be deducted. See Not-for-Profit Activities in See Repayments Under Claim of Right, later. • Capital expenses.

chapter 1 of Pub. 535, Business Expenses. • Check-writing fees.

Repayments of Social Security

Indirect Deductions of Benefits • Club dues.

Pass-Through Entities For information on how to deduct your repay- • Commuting expenses.

Pass-through entities include partnerships, S ments of certain social security benefits, see • Fees and licenses, such as car licenses,

corporations, and mutual funds that aren't pub- Repayments More Than Gross Benefits in marriage licenses, and dog tags.

licly offered. Deductions of pass-through enti- chapter 7. • Fines or penalties.

ties are passed through to the partners or • Health spa expenses.

shareholders. The partner’s or shareholder’s Safe Deposit Box Rent

share of passed-through deductions for invest- • Hobby losses, but see Hobby Expenses,

ment expenses are miscellaneous itemized de- Rent you pay for a safe deposit box you use to earlier.

ductions and can no longer be deducted. store taxable income-producing stocks, bonds, • Home repairs, insurance, and rent.

Nonpublicly offered mutual funds. These or investment-related papers is a miscellaneous • Home security system.

itemized deduction and can no longer be

funds will send you a Form 1099-DIV, Divi- de-ducted. You also can't deduct the rent if you

dends and Distributions, or a substitute form, use the box for jewelry, other personal items, or • Illegal bribes and kickbacks. See Bribes

showing your share of gross income and invest- tax-exempt securities. and kickbacks in chapter 11 of Pub. 535.

ment expenses. The investment expenses re- • Investment-related seminars.

ported on Form 1099-DIV are a miscellaneous • Life insurance premiums paid by the in-

itemized deduction and are no longer deducti- Service Charges on Dividend sured.

ble. Reinvestment Plans

Service charges you pay as a subscriber in a • Lobbying expenses.

dividend reinvestment plan are a miscellaneous • Losses from the sale of your home, furni-

ture, personal car, etc.

Page 100 Chapter 12 Other Itemized Deductions