Page 109 - 2020 Publication 17

P. 109

14:38 - 19-Jan-2021

Page 107 of 138 Fileid: … ations/P17/2020/A/XML/Cycle03/source

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

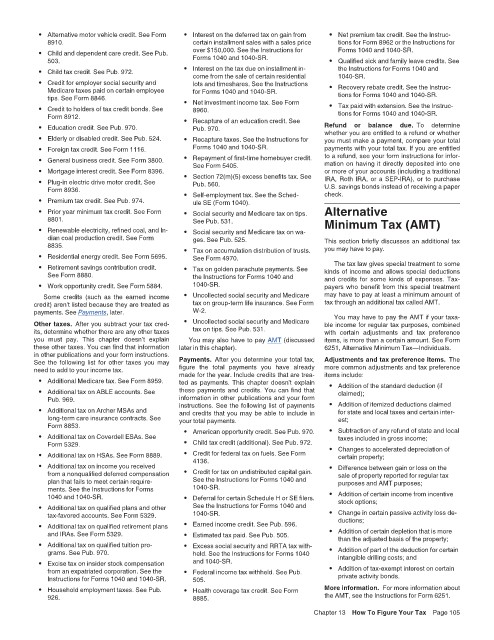

• Alternative motor vehicle credit. See Form • Interest on the deferred tax on gain from • Net premium tax credit. See the Instruc-

8910. certain installment sales with a sales price tions for Form 8962 or the Instructions for

• Child and dependent care credit. See Pub. over $150,000. See the Instructions for Forms 1040 and 1040-SR.

503. Forms 1040 and 1040-SR. • Qualified sick and family leave credits. See

• Child tax credit. See Pub. 972. • Interest on the tax due on installment in- the Instructions for Forms 1040 and

come from the sale of certain residential

1040-SR.

• Credit for employer social security and lots and timeshares. See the Instructions

Medicare taxes paid on certain employee for Forms 1040 and 1040-SR. • Recovery rebate credit. See the Instruc-

tips. See Form 8846. • Net investment income tax. See Form tions for Forms 1040 and 1040-SR.

• Credit to holders of tax credit bonds. See 8960. • Tax paid with extension. See the Instruc-

Form 8912. • Recapture of an education credit. See tions for Forms 1040 and 1040-SR.

• Education credit. See Pub. 970. Pub. 970. Refund or balance due. To determine

whether you are entitled to a refund or whether

• Elderly or disabled credit. See Pub. 524. • Recapture taxes. See the Instructions for you must make a payment, compare your total

• Foreign tax credit. See Form 1116. Forms 1040 and 1040-SR. payments with your total tax. If you are entitled

• General business credit. See Form 3800. • Repayment of first-time homebuyer credit. to a refund, see your form instructions for infor-

mation on having it directly deposited into one

See Form 5405.

• Mortgage interest credit. See Form 8396. • Section 72(m)(5) excess benefits tax. See or more of your accounts (including a traditional

• Plug-in electric drive motor credit. See Pub. 560. IRA, Roth IRA, or a SEP-IRA), or to purchase

Form 8936. • Self-employment tax. See the Sched- U.S. savings bonds instead of receiving a paper

check.

• Premium tax credit. See Pub. 974. ule SE (Form 1040).

• Prior year minimum tax credit. See Form • Social security and Medicare tax on tips. Alternative

8801. See Pub. 531. Minimum Tax (AMT)

• Renewable electricity, refined coal, and In- • Social security and Medicare tax on wa-

dian coal production credit. See Form ges. See Pub. 525. This section briefly discusses an additional tax

8835. • Tax on accumulation distribution of trusts. you may have to pay.

• Residential energy credit. See Form 5695. See Form 4970.

• Retirement savings contribution credit. • Tax on golden parachute payments. See The tax law gives special treatment to some

See Form 8880. the Instructions for Forms 1040 and kinds of income and allows special deductions

and credits for some kinds of expenses. Tax-

• Work opportunity credit. See Form 5884. 1040-SR. payers who benefit from this special treatment

Some credits (such as the earned income • Uncollected social security and Medicare may have to pay at least a minimum amount of

credit) aren’t listed because they are treated as tax on group-term life insurance. See Form tax through an additional tax called AMT.

payments. See Payments, later. W-2. You may have to pay the AMT if your taxa-

Other taxes. After you subtract your tax cred- • Uncollected social security and Medicare ble income for regular tax purposes, combined

its, determine whether there are any other taxes tax on tips. See Pub. 531. with certain adjustments and tax preference

you must pay. This chapter doesn’t explain You may also have to pay AMT (discussed items, is more than a certain amount. See Form

these other taxes. You can find that information later in this chapter). 6251, Alternative Minimum Tax—Individuals.

in other publications and your form instructions.

See the following list for other taxes you may Payments. After you determine your total tax, Adjustments and tax preference items. The

need to add to your income tax. figure the total payments you have already more common adjustments and tax preference

items include:

made for the year. Include credits that are trea-

• Additional Medicare tax. See Form 8959. ted as payments. This chapter doesn’t explain • Addition of the standard deduction (if

• Additional tax on ABLE accounts. See these payments and credits. You can find that claimed);

Pub. 969. information in other publications and your form

• Additional tax on Archer MSAs and instructions. See the following list of payments • Addition of itemized deductions claimed

for state and local taxes and certain inter-

and credits that you may be able to include in

long-term care insurance contracts. See your total payments. est;

Form 8853. • Subtraction of any refund of state and local

• Additional tax on Coverdell ESAs. See • American opportunity credit. See Pub. 970. taxes included in gross income;

Form 5329. • Child tax credit (additional). See Pub. 972. • Changes to accelerated depreciation of

• Additional tax on HSAs. See Form 8889. • Credit for federal tax on fuels. See Form certain property;

4136.

• Additional tax on income you received • Difference between gain or loss on the

from a nonqualified deferred compensation • Credit for tax on undistributed capital gain. sale of property reported for regular tax

plan that fails to meet certain require- See the Instructions for Forms 1040 and purposes and AMT purposes;

ments. See the Instructions for Forms 1040-SR.

1040 and 1040-SR. • Deferral for certain Schedule H or SE filers. • Addition of certain income from incentive

stock options;

• Additional tax on qualified plans and other See the Instructions for Forms 1040 and

tax-favored accounts. See Form 5329. 1040-SR. • Change in certain passive activity loss de-

ductions;

• Additional tax on qualified retirement plans • Earned income credit. See Pub. 596.

and IRAs. See Form 5329. • Estimated tax paid. See Pub. 505. • Addition of certain depletion that is more

than the adjusted basis of the property;

• Additional tax on qualified tuition pro- • Excess social security and RRTA tax with-

grams. See Pub. 970. held. See the Instructions for Forms 1040 • Addition of part of the deduction for certain

intangible drilling costs; and

• Excise tax on insider stock compensation and 1040-SR.

from an expatriated corporation. See the • Federal income tax withheld. See Pub. • Addition of tax-exempt interest on certain

Instructions for Forms 1040 and 1040-SR. 505. private activity bonds.

• Household employment taxes. See Pub. • Health coverage tax credit. See Form More information. For more information about

926. 8885. the AMT, see the Instructions for Form 6251.

Chapter 13 How To Figure Your Tax Page 105