Page 81 - Dependents for Individuals

P. 81

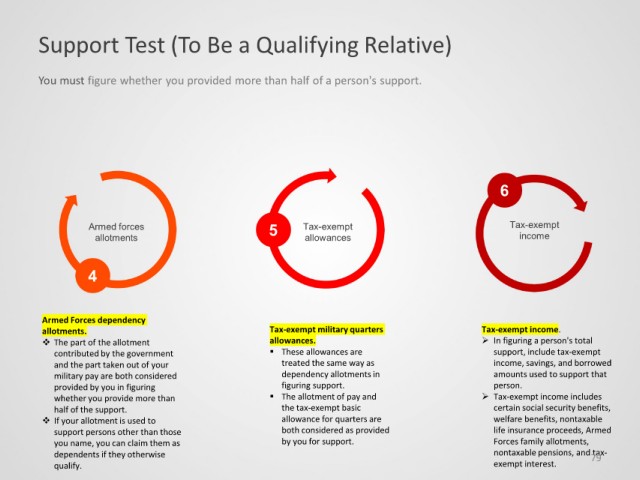

Support Test (To Be a Qualifying Relative)

You must figure whether you provided more than half of a person's support.

6

Armed forces 5 Tax-exempt Tax-exempt

allotments allowances income

4

Armed Forces dependency

allotments. Tax-exempt military quarters Tax-exempt income.

The part of the allotment allowances. In figuring a person's total

contributed by the government These allowances are support, include tax-exempt

and the part taken out of your treated the same way as income, savings, and borrowed

military pay are both considered dependency allotments in amounts used to support that

provided by you in figuring figuring support. person.

whether you provide more than The allotment of pay and Tax-exempt income includes

half of the support. the tax-exempt basic certain social security benefits,

If your allotment is used to allowance for quarters are welfare benefits, nontaxable

support persons other than those both considered as provided life insurance proceeds, Armed

you name, you can claim them as by you for support. Forces family allotments,

dependents if they otherwise nontaxable pensions, and tax-

79

qualify. exempt interest.