Page 73 - Interest Income - Individuals Handbook

P. 73

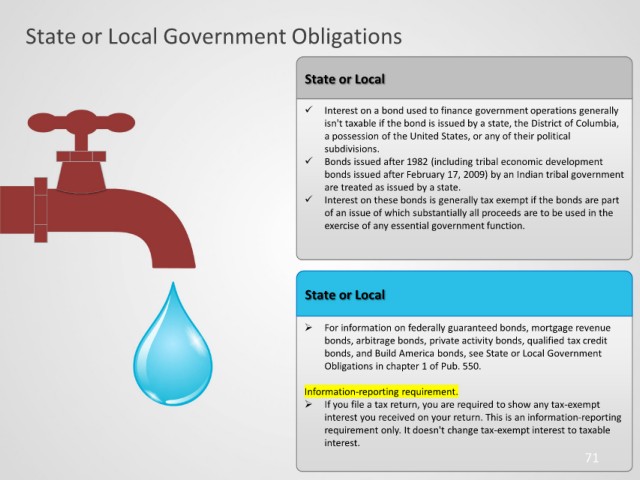

State or Local Government Obligations

State or Local

Interest on a bond used to finance government operations generally

isn't taxable if the bond is issued by a state, the District of Columbia,

a possession of the United States, or any of their political

subdivisions.

Bonds issued after 1982 (including tribal economic development

bonds issued after February 17, 2009) by an Indian tribal government

are treated as issued by a state.

Interest on these bonds is generally tax exempt if the bonds are part

of an issue of which substantially all proceeds are to be used in the

exercise of any essential government function.

State or Local

For information on federally guaranteed bonds, mortgage revenue

bonds, arbitrage bonds, private activity bonds, qualified tax credit

bonds, and Build America bonds, see State or Local Government

Obligations in chapter 1 of Pub. 550.

Information-reporting requirement.

If you file a tax return, you are required to show any tax-exempt

interest you received on your return. This is an information-reporting

requirement only. It doesn't change tax-exempt interest to taxable

interest.

71