Page 76 - Interest Income - Individuals Handbook

P. 76

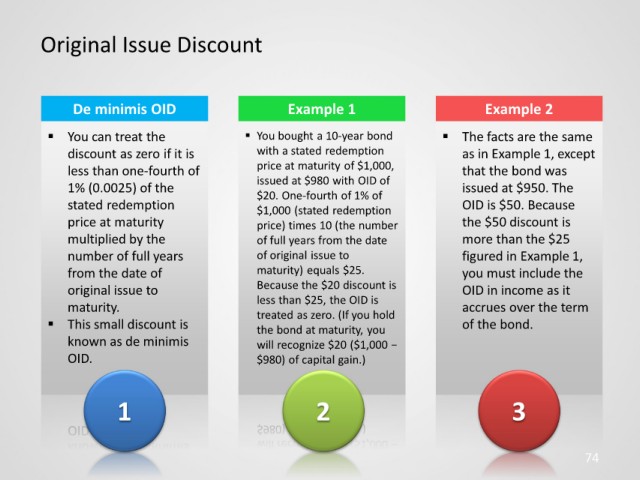

Original Issue Discount

De minimis OID Example 1 Example 2

You can treat the You bought a 10-year bond The facts are the same

discount as zero if it is with a stated redemption as in Example 1, except

less than one-fourth of price at maturity of $1,000, that the bond was

1% (0.0025) of the issued at $980 with OID of issued at $950. The

$20. One-fourth of 1% of

stated redemption $1,000 (stated redemption OID is $50. Because

price at maturity price) times 10 (the number the $50 discount is

multiplied by the of full years from the date more than the $25

number of full years of original issue to figured in Example 1,

from the date of maturity) equals $25. you must include the

original issue to Because the $20 discount is OID in income as it

maturity. less than $25, the OID is accrues over the term

This small discount is treated as zero. (If you hold of the bond.

the bond at maturity, you

known as de minimis will recognize $20 ($1,000 −

OID. $980) of capital gain.)

1 2 3

74