Page 23 - Keeping Business Records

P. 23

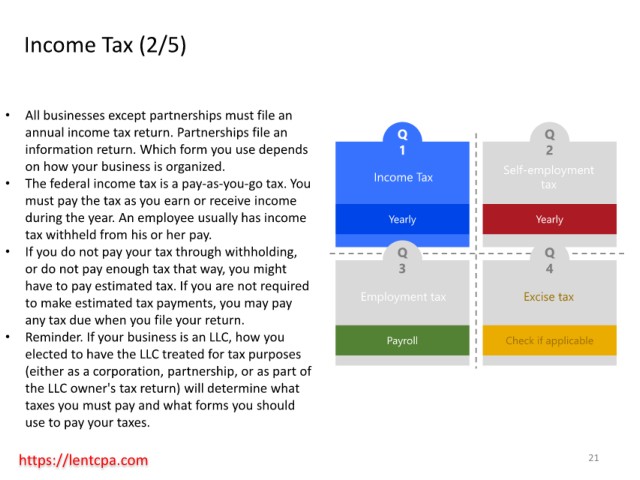

Income Tax (2/5)

• All businesses except partnerships must file an

annual income tax return. Partnerships file an Q Q

information return. Which form you use depends 1 2

on how your business is organized. Self-employment

• The federal income tax is a pay-as-you-go tax. You Income Tax tax

must pay the tax as you earn or receive income

during the year. An employee usually has income Yearly Yearly

tax withheld from his or her pay.

• If you do not pay your tax through withholding, Q Q

or do not pay enough tax that way, you might 3 4

have to pay estimated tax. If you are not required

to make estimated tax payments, you may pay Employment tax Excise tax

any tax due when you file your return.

• Reminder. If your business is an LLC, how you Payroll Check if applicable

elected to have the LLC treated for tax purposes

(either as a corporation, partnership, or as part of

the LLC owner's tax return) will determine what

taxes you must pay and what forms you should

use to pay your taxes.

https://lentcpa.com 21