Page 24 - Keeping Business Records

P. 24

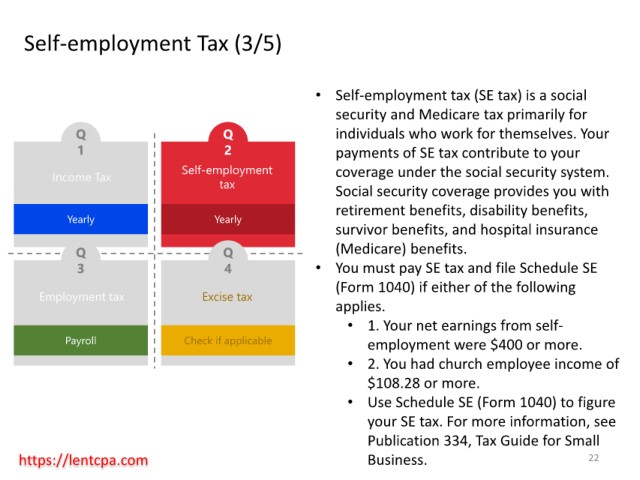

Self-employment Tax (3/5)

• Self-employment tax (SE tax) is a social

security and Medicare tax primarily for

Q Q individuals who work for themselves. Your

1 2 payments of SE tax contribute to your

Self-employment coverage under the social security system.

Income Tax

tax Social security coverage provides you with

retirement benefits, disability benefits,

Yearly Yearly

survivor benefits, and hospital insurance

(Medicare) benefits.

Q Q

3 4 • You must pay SE tax and file Schedule SE

(Form 1040) if either of the following

Employment tax Excise tax

applies.

• 1. Your net earnings from self-

Payroll Check if applicable employment were $400 or more.

• 2. You had church employee income of

$108.28 or more.

• Use Schedule SE (Form 1040) to figure

your SE tax. For more information, see

Publication 334, Tax Guide for Small

https://lentcpa.com Business. 22