Page 55 - Keeping Business Records

P. 55

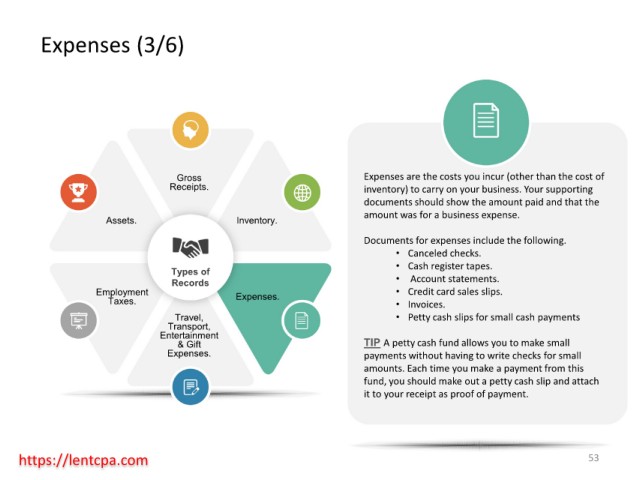

Expenses (3/6)

Gross Expenses are the costs you incur (other than the cost of

Receipts. inventory) to carry on your business. Your supporting

documents should show the amount paid and that the

amount was for a business expense.

Assets. Inventory.

Documents for expenses include the following.

• Canceled checks.

• Cash register tapes.

Types of

Records • Account statements.

Employment Expenses. • Credit card sales slips.

Taxes. • Invoices.

Travel, • Petty cash slips for small cash payments

Transport,

Entertainment

& Gift TIP A petty cash fund allows you to make small

Expenses. payments without having to write checks for small

amounts. Each time you make a payment from this

fund, you should make out a petty cash slip and attach

it to your receipt as proof of payment.

https://lentcpa.com 53