Page 78 - Wages, Salaries and Other Earnings

P. 78

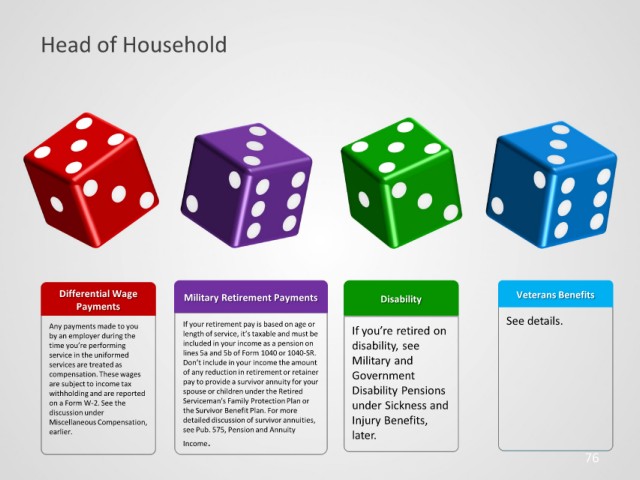

Head of Household

Differential Wage Military Retirement Payments Disability Veterans Benefits

Payments

Any payments made to you If your retirement pay is based on age or If you’re retired on See details.

by an employer during the length of service, it’s taxable and must be

time you’re performing included in your income as a pension on disability, see

service in the uniformed lines 5a and 5b of Form 1040 or 1040-SR.

services are treated as Don’t include in your income the amount Military and

compensation. These wages of any reduction in retirement or retainer Government

are subject to income tax pay to provide a survivor annuity for your

withholding and are reported spouse or children under the Retired Disability Pensions

on a Form W-2. See the Serviceman's Family Protection Plan or under Sickness and

discussion under the Survivor Benefit Plan. For more

Miscellaneous Compensation, detailed discussion of survivor annuities, Injury Benefits,

earlier. see Pub. 575, Pension and Annuity later.

Income.

76