Page 91 - Wages, Salaries and Other Earnings

P. 91

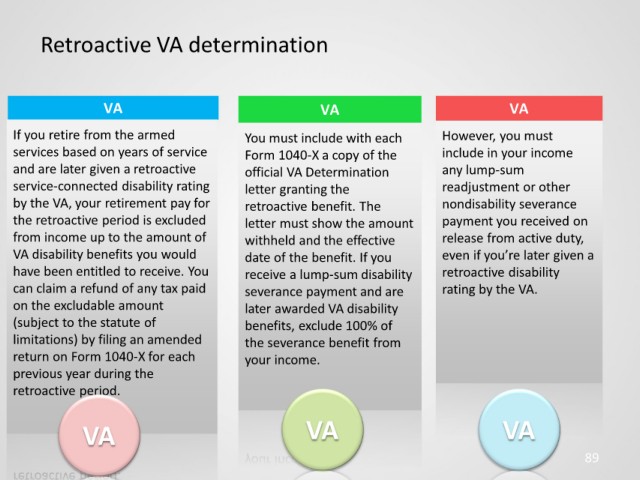

Retroactive VA determination

VA VA VA

If you retire from the armed You must include with each However, you must

services based on years of service Form 1040-X a copy of the include in your income

and are later given a retroactive official VA Determination any lump-sum

service-connected disability rating letter granting the readjustment or other

by the VA, your retirement pay for retroactive benefit. The nondisability severance

the retroactive period is excluded letter must show the amount payment you received on

from income up to the amount of withheld and the effective release from active duty,

VA disability benefits you would date of the benefit. If you even if you’re later given a

have been entitled to receive. You receive a lump-sum disability retroactive disability

can claim a refund of any tax paid severance payment and are rating by the VA.

on the excludable amount later awarded VA disability

(subject to the statute of benefits, exclude 100% of

limitations) by filing an amended the severance benefit from

return on Form 1040-X for each your income.

previous year during the

retroactive period.

VA VA VA

89