Page 166 - CA Final GST

P. 166

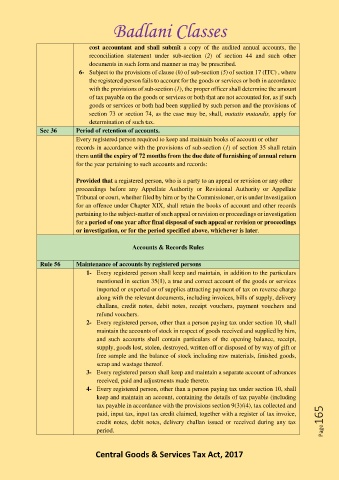

Badlani Classes

cost accountant and shall submit a copy of the audited annual accounts, the

reconciliation statement under sub-section (2) of section 44 and such other

documents in such form and manner as may be prescribed.

6- Subject to the provisions of clause (h) of sub-section (5) of section 17 (ITC) , where

the registered person fails to account for the goods or services or both in accordance

with the provisions of sub-section (1), the proper officer shall determine the amount

of tax payable on the goods or services or both that are not accounted for, as if such

goods or services or both had been supplied by such person and the provisions of

section 73 or section 74, as the case may be, shall, mutatis mutandis, apply for

determination of such tax.

Sec 36 Period of retention of accounts.

Every registered person required to keep and maintain books of account or other

records in accordance with the provisions of sub-section (1) of section 35 shall retain

them until the expiry of 72 months from the due date of furnishing of annual return

for the year pertaining to such accounts and records:

Provided that a registered person, who is a party to an appeal or revision or any other

proceedings before any Appellate Authority or Revisional Authority or Appellate

Tribunal or court, whether filed by him or by the Commissioner, or is under investigation

for an offence under Chapter XIX, shall retain the books of account and other records

pertaining to the subject-matter of such appeal or revision or proceedings or investigation

for a period of one year after final disposal of such appeal or revision or proceedings

or investigation, or for the period specified above, whichever is later.

Accounts & Records Rules

Rule 56 Maintenance of accounts by registered persons

1- Every registered person shall keep and maintain, in addition to the particulars

mentioned in section 35(1), a true and correct account of the goods or services

imported or exported or of supplies attracting payment of tax on reverse charge

along with the relevant documents, including invoices, bills of supply, delivery

challans, credit notes, debit notes, receipt vouchers, payment vouchers and

refund vouchers.

2- Every registered person, other than a person paying tax under section 10, shall

maintain the accounts of stock in respect of goods received and supplied by him,

and such accounts shall contain particulars of the opening balance, receipt,

supply, goods lost, stolen, destroyed, written off or disposed of by way of gift or

free sample and the balance of stock including raw materials, finished goods,

scrap and wastage thereof.

3- Every registered person shall keep and maintain a separate account of advances

received, paid and adjustments made thereto.

4- Every registered person, other than a person paying tax under section 10, shall

keep and maintain an account, containing the details of tax payable (including

tax payable in accordance with the provisions section 9(3)/(4), tax collected and

paid, input tax, input tax credit claimed, together with a register of tax invoice,

credit notes, debit notes, delivery challan issued or received during any tax Page165

period.

Central Goods & Services Tax Act, 2017