Page 170 - CA Final GST

P. 170

Badlani Classes

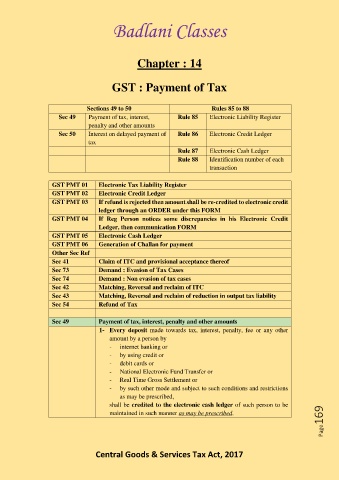

Chapter : 14

GST : Payment of Tax

Sections 49 to 50 Rules 85 to 88

Sec 49 Payment of tax, interest, Rule 85 Electronic Liability Register

penalty and other amounts

Sec 50 Interest on delayed payment of Rule 86 Electronic Credit Ledger

tax

Rule 87 Electronic Cash Ledger

Rule 88 Identification number of each

transaction

GST PMT 01 Electronic Tax Liability Register

GST PMT 02 Electronic Credit Ledger

GST PMT 03 If refund is rejected then amount shall be re-credited to electronic credit

ledger through an ORDER under this FORM

GST PMT 04 If Reg Person notices some discrepancies in his Electronic Credit

Ledger, then communication FORM

GST PMT 05 Electronic Cash Ledger

GST PMT 06 Generation of Challan for payment

Other Sec Ref

Sec 41 Claim of ITC and provisional acceptance thereof

Sec 73 Demand : Evasion of Tax Cases

Sec 74 Demand : Non evasion of tax cases

Sec 42 Matching, Reversal and reclaim of ITC

Sec 43 Matching, Reversal and reclaim of reduction in output tax liability

Sec 54 Refund of Tax

Sec 49 Payment of tax, interest, penalty and other amounts

1- Every deposit made towards tax, interest, penalty, fee or any other

amount by a person by

- internet banking or

- by using credit or

- debit cards or

- National Electronic Fund Transfer or

- Real Time Gross Settlement or

- by such other mode and subject to such conditions and restrictions

as may be prescribed,

shall be credited to the electronic cash ledger of such person to be

Page169

maintained in such manner as may be prescribed.

Central Goods & Services Tax Act, 2017