Page 239 - CA Final GST

P. 239

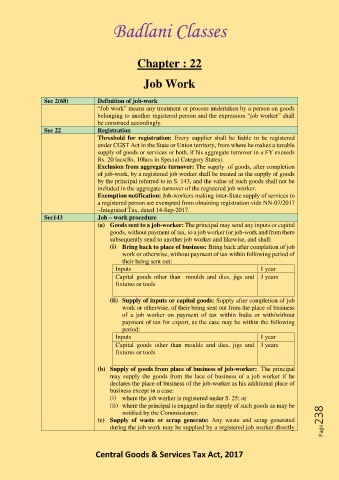

Badlani Classes

Chapter : 22

Job Work

Sec 2(68) Definition of job-work

“Job work” means any treatment or process undertaken by a person on goods

belonging to another registered person and the expression “job worker” shall

be construed accordingly.

Sec 22 Registration

Threshold for registration: Every supplier shall be liable to be registered

under CGST Act in the State or Union territory, from where he makes a taxable

supply of goods or services or both, if his aggregate turnover in a FY exceeds

Rs. 20 lacs(Rs. 10lacs in Special Category States).

Exclusion from aggregate turnover: The supply of goods, after completion

of job-work, by a registered job worker shall be treated as the supply of goods

by the principal referred to in S. 143, and the value of such goods shall not be

included in the aggregate turnover of the registered job worker.

Exemption notification: Job-workers making inter-State supply of services to

a registered person are exempted from obtaining registration vide NN-07/2017

–Integrated Tax, dated 14-Sep-2017.

Sec143 Job – work procedure

(a) Goods sent to a job-worker: The principal may send any inputs or capital

goods, without payment of tax, to a job worker for job-work and from there

subsequently send to another job worker and likewise, and shall:

(i) Bring back to place of business: Bring back after completion of job

work or otherwise, without payment of tax within following period of

their being sent out:

Inputs 1 year

Capital goods other than moulds and dies, jigs and 3 years

fixtures or tools

(ii) Supply of inputs or capital goods: Supply after completion of job

work or otherwise, of their being sent out from the place of business

of a job worker on payment of tax within India or with/without

payment of tax for export, as the case may be within the following

period:

Inputs 1 year

Capital goods other than moulds and dies, jigs and 3 years

fixtures or tools

(b) Supply of goods from place of business of job-worker: The principal

may supply the goods from the lace of business of a job worker if he

declares the place of business of the job-worker as his additional place of

business except in a case:

(i) where the job worker is registered under S. 25; or

(ii) where the principal is engaged in the supply of such goods as may be

notified by the Commissioner.

(c) Supply of waste or scrap generate: Any waste and scrap generated Page238

during the job work may be supplied by a registered job worker directly

Central Goods & Services Tax Act, 2017