Page 241 - CA Final GST

P. 241

Badlani Classes

ITC- 04 furnished for that period on or before the twenty –fifth day of the

month succeeding the said quarter or within such further period as may e

extended by the Commissioner by a notification in this behalf.

Provided that any extension of the time limit notified by the Commissioner

of State tax or the Commissioner of Union territory tax shall be deemed to

be notified by the Commissioner.[Rule 45(3) ]

Central Government vide NN-63/2017-Central Tax, dated 15-Nov-2017,

extended the time limit for making declaration in FORM GST ITC -04 in

respect of goods dispatched to a job worker or received from a job worker

or sent from one job worker to another, during the quarter July-Sep-2017

ti 31-Dec-2017.

• Deemed supply if goods not returned within specified time: Where the

inputs or capital goods are not returned to the principal within the time

stipulated in S. 143, it shall be deemed that such inputs or capital goods

had been supplied by the principal to the job worker on the day when the

said inputs or capital goods were sent out and the said sup0ply shall be

declared in FORM GSTR-1 and the principal shall be liable to pay the tax

along with applicable interest [Rule 45(4) ]

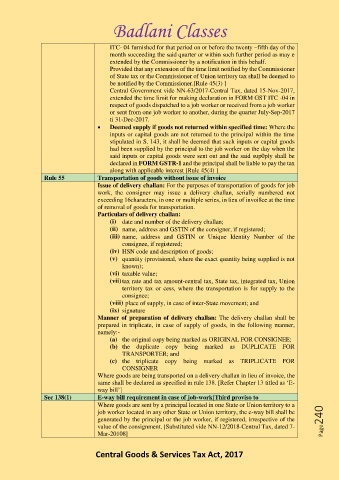

Rule 55 Transportation of goods without issue of invoice

Issue of delivery challan: For the purposes of transportation of goods for job

work, the consigner may issue a delivery challan, serially numbered not

exceeding 16characters, in one or multiple series, in lieu of invoi8ce at the time

of removal of goods for transportation.

Particulars of delivery challan:

(i) date and number of the delivery challan;

(ii) name, address and GSTIN of the consigner, if registered;

(iii) name, address and GSTIN or Unique Identity Number of the

consignee, if registered;

(iv) HSN code and description of goods;

(v) quantity (provisional, where the exact quantity being supplied is not

known);

(vi) taxable value;

(vii) tax rate and tax amount-central tax, State tax, integrated tax, Union

territory tax or cess, where the transportation is for supply to the

consignee;

(viii) place of supply, in case of inter-State movement; and

(ix) signature

Manner of preparation of delivery challan: The delivery challan shall be

prepared in triplicate, in case of supply of goods, in the following manner,

namely:-

(a) the original copy being marked as ORIGINAL FOR CONSIGNEE;

(b) the duplicate copy being marked as DUPLICATE FOR

TRANSPORTER; and

(c) the triplicate copy being marked as TRIPLICATE FOR

CONSIGNER

Where goods are being transported on a delivery challan in lieu of invoice, the

same shall be declared as specified in rule 138. [Refer Chapter 13 titled as ‘E-

way bill’]

Sec 138(1) E-way bill requirement in case of job-work[Third proviso to

Where goods are sent by a principal located in one State or Union territory to a

job worker located in any other State or Union territory, the e-way bill shall be

generated by the principal or the job worker, if registered, irrespective of the Page240

value of the consignment. [Substituted vide NN-12/2018-Central Tax, dated 7-

Mar-20108]

Central Goods & Services Tax Act, 2017