Page 246 - CA Final GST

P. 246

Badlani Classes

input tax credit availed by the recipient shall be addedto his output tax liability, along

with interest thereon, in such manner as may beprescribed:(See Example 2)

Provided also that the recipient shall be entitled to avail of the credit of input taxon

payment made by him of the amount towards the value of supply of goods orservices

or both along with tax payable thereon. (See Example 3)

3- Where the registered person has claimed depreciation on the tax component of thecost

of capital goods and plant and machinery under the provisions of the Income-tax

Act,1961, the input tax credit on the said tax component shall not be allowed.

4- A registered person shall not be entitled to take input tax credit in respect of anyinvoice

or debit note for supply of goods or services or both :

- after the due date of furnishingof the return under section 39 for the month of

September (i.e. 20 October)following the end of financial yearto which such

th

invoice or invoice relating to such debit note pertains or

- furnishing of therelevant annual return, (i.e. 31 Dec of next year)

st

whichever is earlier.(See Example 4 & 5)

Example 1 : Mr X is a furniture dealer. On 1 aug 2017 he purchases 100 chairs from a manufacturer,

st

valued at Rs 5,000/- each. It is agreed that the chair will be sent by the manufacturer in 2 lots of 50 chairs

each.

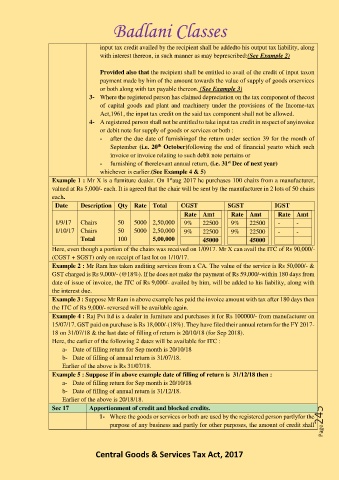

Date Description Qty Rate Total CGST SGST IGST

Rate Amt Rate Amt Rate Amt

1/9/17 Chairs 50 5000 2,50,000 9% 22500 9% 22500 - -

1/10/17 Chairs 50 5000 2,50,000 9% 22500 9% 22500 - -

Total 100 5,00,000 45000 45000

Here, even though a portion of the chairs was received on 1/0917. Mr X can avail the ITC of Rs 90,000/-

(CGST + SGST) only on receipt of last lot on 1/10/17.

Example 2 : Mr Ram has taken auditing services from a CA. The value of the service is Rs 50,000/- &

GST charged is Rs 9,000/- (@18%). If he does not make the payment of Rs 59,000/-within 180 days from

date of issue of invoice, the ITC of Rs 9,000/- availed by him, will be added to his liability, along with

the interest due.

Example 3 : Suppose Mr Ram in above example has paid the invoice amount with tax after 180 days then

the ITC of Rs 9,000/- reversed will be available again.

Example 4 : Raj Pvt ltd is a dealer in furniture and purchases it for Rs 100000/- from manufacturer on

15/07/17. GST paid on purchase is Rs 18,000/-(18%). They have filed their annual return for the FY 2017-

18 on 31/07/18 & the last date of filling of return is 20/10/18 (for Sep 2018).

Here, the earlier of the following 2 dates will be available for ITC :

a- Date of filling return for Sep month is 20/10/18

b- Date of filling of annual return is 31/07/18.

Earlier of the above is Rs 31/07/18.

Example 5 : Suppose if in above example date of filling of return is 31/12/18 then :

a- Date of filling return for Sep month is 20/10/18

b- Date of filling of annual return is 31/12/18.

Earlier of the above is 20/18/18.

Sec 17 Apportionment of credit and blocked credits.

1- Where the goods or services or both are used by the registered person partlyfor the Page245

purpose of any business and partly for other purposes, the amount of credit shall

Central Goods & Services Tax Act, 2017