Page 249 - CA Final GST

P. 249

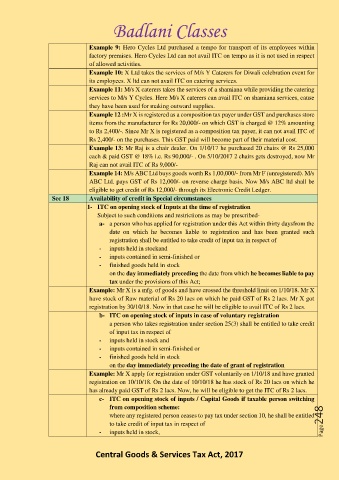

Badlani Classes

Example 9: Hero Cycles Ltd purchased a tempo for transport of its employees within

factory premises. Hero Cycles Ltd can not avail ITC on tempo as it is not used in respect

of allowed activities.

Example 10: X Ltd takes the services of M/s Y Caterers for Diwali celebration event for

its employees. X ltd can not avail ITC on catering services.

Example 11: M/s X caterers takes the services of a shamiana while providing the catering

services to M/s Y Cycles. Here M/s X caterers can avail ITC on shamiana services, cause

they have been used for making outward supplies.

Example 12 :Mr X is registered as a composition tax payer under GST and purchases store

items from the manufacturer for Rs 20,000/- on which GST is charged @ 12% amounting

to Rs 2,400/-. Since Mr X is registered as a composition tax payer, it can not avail ITC of

Rs 2,400/- on the purchases. This GST paid will become part of their material cost.

Example 13: Mr Raj is a chair dealer. On 1/10/17 he purchased 20 chairs @ Rs 25,000

each & paid GST @ 18% i.e. Rs 90,000/- . On 5/10/2017 2 chairs gets destroyed, now Mr

Raj can not avail ITC of Rs 9,000/-

Example 14: M/s ABC Ltd buys goods worth Rs 1,00,000/- from Mr F (unregistered). M/s

ABC Ltd. pays GST of Rs 12,000/- on reverse charge basis. Now M/s ABC ltd shall be

eligible to get credit of Rs 12,000/- through its Electronic Credit Ledger.

Sec 18 Availability of credit in Special circumstances

1- ITC on opening stock of Inputs at the time of registration

Subject to such conditions and restrictions as may be prescribed-

a- a person who has applied for registration under this Act within thirty daysfrom the

date on which he becomes liable to registration and has been granted such

registration shall be entitled to take credit of input tax in respect of

- inputs held in stockand

- inputs contained in semi-finished or

- finished goods held in stock

on the day immediately preceding the date from which he becomes liable to pay

tax under the provisions of this Act;

Example: Mr X is a mfg. of goods and have crossed the threshold limit on 1/10/18. Mr X

have stock of Raw material of Rs 20 lacs on which he paid GST of Rs 2 lacs. Mr X got

registration by 30/10/18. Now in that case he will be eligible to avail ITC of Rs 2 lacs.

b- ITC on opening stock of inputs in case of voluntary registration

a person who takes registration under section 25(3) shall be entitled to take credit

of input tax in respect of

- inputs held in stock and

- inputs contained in semi-finished or

- finished goods held in stock

on the day immediately preceding the date of grant of registration

Example: Mr X apply for registration under GST voluntarily on 1/10/18 and have granted

registration on 10/10/18. On the date of 10/10/18 he has stock of Rs 20 lacs on which he

has already paid GST of Rs 2 lacs. Now, he will be eligible to get the ITC of Rs 2 lacs.

c- ITC on opening stock of inputs / Capital Goods if taxable person switching

from composition scheme:

where any registered person ceases to pay tax under section 10, he shall be entitled

to take credit of input tax in respect of Page248

- inputs held in stock,

Central Goods & Services Tax Act, 2017