Page 248 - CA Final GST

P. 248

Badlani Classes

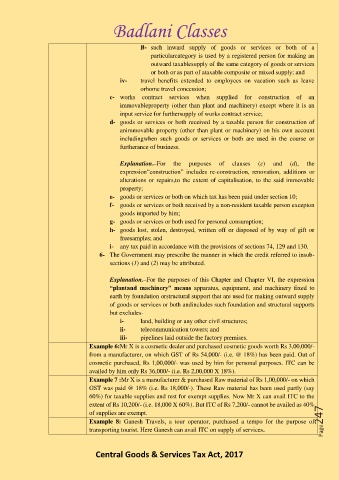

B- such inward supply of goods or services or both of a

particularcategory is used by a registered person for making an

outward taxablesupply of the same category of goods or services

or both or as part of ataxable composite or mixed supply; and

iv- travel benefits extended to employees on vacation such as leave

orhome travel concession;

c- works contract services when supplied for construction of an

immovableproperty (other than plant and machinery) except where it is an

input service for furthersupply of works contract service;

d- goods or services or both received by a taxable person for construction of

animmovable property (other than plant or machinery) on his own account

includingwhen such goods or services or both are used in the course or

furtherance of business.

Explanation.–For the purposes of clauses (c) and (d), the

expression“construction” includes re-construction, renovation, additions or

alterations or repairs,to the extent of capitalisation, to the said immovable

property;

e- goods or services or both on which tax has been paid under section 10;

f- goods or services or both received by a non-resident taxable person excepton

goods imported by him;

g- goods or services or both used for personal consumption;

h- goods lost, stolen, destroyed, written off or disposed of by way of gift or

freesamples; and

i- any tax paid in accordance with the provisions of sections 74, 129 and 130.

6- The Government may prescribe the manner in which the credit referred to insub-

sections (1) and (2) may be attributed.

Explanation.–For the purposes of this Chapter and Chapter VI, the expression

“plantand machinery” means apparatus, equipment, and machinery fixed to

earth by foundation orstructural support that are used for making outward supply

of goods or services or both andincludes such foundation and structural supports

but excludes-

i- land, building or any other civil structures;

ii- telecommunication towers; and

iii- pipelines laid outside the factory premises.

Example 6:Mr X is a cosmetic dealer and purchased cosmetic goods worth Rs 3,00,000/-

from a manufacturer, on which GST of Rs 54,000/- (i.e. @ 18%) has been paid. Out of

cosmetic purchased, Rs 1,00,000/- was used by him for personal purposes. ITC can be

availed by him only Rs 36,000/- (i.e. Rs 2,00,000 X 18%).

Example 7 :Mr X is a manufacturer & purchased Raw material of Rs 1,00,000/- on which

GST was paid @ 18% (i.e. Rs 18,000/-). These Raw material has been used partly (say

60%) for taxable supplies and rest for exempt supplies. Now Mr X can avail ITC to the

extent of Rs 10,200/- (i.e. 18,000 X 60%). But ITC of Rs 7,200/- cannot be availed as 40%

of supplies are exempt.

Example 8: Ganesh Travels, a tour operator, purchased a tempo for the purpose of Page247

transporting tourist. Here Ganesh can avail ITC on supply of services.

Central Goods & Services Tax Act, 2017