Page 299 - CA Final GST

P. 299

Badlani Classes

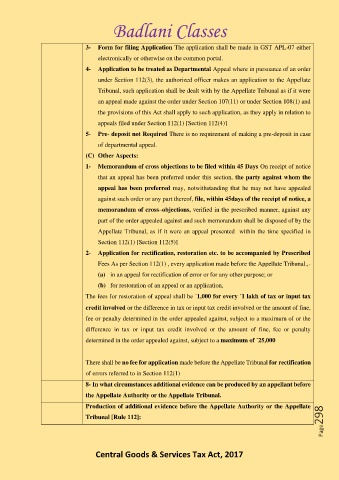

3- Form for filing Application The application shall be made in GST APL-07 either

electronically or otherwise on the common portal.

4- Application to be treated as Departmental Appeal where in pursuance of an order

under Section 112(3), the authorized officer makes an application to the Appellate

Tribunal, such application shall be dealt with by the Appellate Tribunal as if it were

an appeal made against the order under Section 107(11) or under Section 108(1) and

the provisions of this Act shall apply to such application, as they apply in relation to

appeals filed under Section 112(1) [Section 112(4)]

5- Pre- deposit not Required There is no requirement of making a pre-deposit in case

of departmental appeal.

(C) Other Aspects:

1- Memorandum of cross objections to be filed within 45 Days On receipt of notice

that an appeal has been preferred under this section, the party against whom the

appeal has been preferred may, notwithstanding that he may not have appealed

against such order or any part thereof, file, within 45days of the receipt of notice, a

memorandum of cross–objections, verified in the prescribed manner, against any

part of the order appealed against and such memorandum shall be disposed of by the

Appellate Tribunal, as if it were an appeal presented within the time specified in

Section 112(1) [Section 112(5)]

2- Application for rectification, restoration etc. to be accompanied by Prescribed

Fees As per Section 112(1) , every application made before the Appellate Tribunal.,-

(a) in an appeal for rectification of error or for any other purpose; or

(b) for restoration of an appeal or an application,

The fees for restoration of appeal shall be `1,000 for every `1 lakh of tax or input tax

credit involved or the difference in tax or input tax credit involved or the amount of fine,

fee or penalty determined in the order appealed against, subject to a maximum of or the

difference in tax or input tax credit involved or the amount of fine, fee or penalty

determined in the order appealed against, subject to a maximum of `25,000

There shall be no fee for application made before the Appellate Tribunal for rectification

of errors referred to in Section 112(1)

8- In what circumstances additional evidence can be produced by an appellant before

the Appellate Authority or the Appellate Tribunal.

Page298

Production of additional evidence before the Appellate Authority or the Appellate

Tribunal [Rule 112]:

Central Goods & Services Tax Act, 2017