Page 302 - CA Final GST

P. 302

Badlani Classes

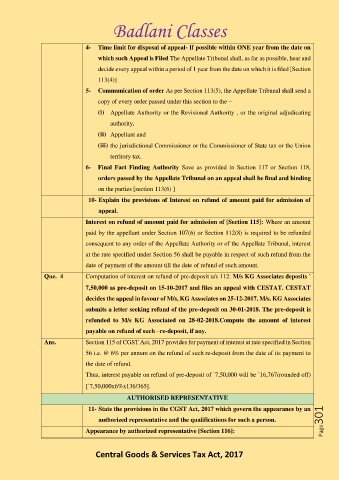

4- Time limit for disposal of appeal- If possible within ONE year from the date on

which such Appeal is Filed The Appellate Tribunal shall, as far as possible, hear and

decide every appeal within a period of 1 year from the date on which it is filed [Section

113(4)]

5- Communication of order As per Section 113(5), the Appellate Tribunal shall send a

copy of every order passed under this section to the –

(i) Appellate Authority or the Revisional Authority , or the original adjudicating

authority,

(ii) Appellant and

(iii) the jurisdictional Commissioner or the Commissioner of State tax or the Union

territory tax.

6- Final Fact Finding Authority Save as provided in Section 117 or Section 118,

orders passed by the Appellate Tribunal on an appeal shall be final and binding

on the parties [section 113(6) ]

10- Explain the provisions of Interest on refund of amount paid for admission of

appeal.

Interest on refund of amount paid for admission of [Section 115]: Where an amount

paid by the appellant under Section 107(6) or Section 112(8) is required to be refunded

consequent to any order of the Appellate Authority or of the Appellate Tribunal, interest

at the rate specified under Section 56 shall be payable in respect of such refund from the

date of payment of the amount till the date of refund of such amount.

Que. 4 Computation of interest on refund of pre-deposit u/s 112: M/s KG Associates deposits `

7,50,000 as pre-deposit on 15-10-2017 and files an appeal with CESTAT. CESTAT

decides the appeal in favour of M/s, KG Associates on 25-12-2017. M/s. KG Associates

submits a letter seeking refund of the pre-deposit on 30-01-2018. The pre-deposit is

refunded to M/s KG Associated on 28-02-2018.Compute the amount of interest

payable on refund of such –re-deposit, if any.

Ans. Section 115 of CGST Act, 2017 provides for payment of interest at rate specified in Section

56 i.e. @ 6% per annum on the refund of such re-deposit from the date of its payment to

the date of refund.

Thus, interest payable on refund of pre-deposit of `7,50,000 will be `16,767(rounded off)

[`7,50,000x6%x136/365].

AUTHORISED REPRESENTATIVE

11- State the provisions in the CGST Act, 2017 which govern the appearance by an

authorized representative and the qualifications for such a person. Page301

Appearance by authorized representative [Section 116]:

Central Goods & Services Tax Act, 2017