Page 305 - CA Final GST

P. 305

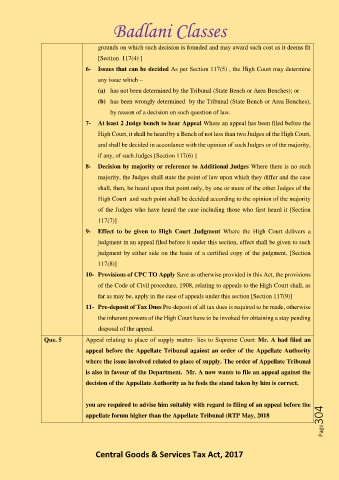

Badlani Classes

grounds on which such decision is founded and may award such cost as it deems fit

[Section 117(4) ]

6- Issues that can be decided As per Section 117(5) , the High Court may determine

any issue which –

(a) has not been determined by the Tribunal (State Bench or Area Benches); or

(b) has been wrongly determined by the Tribunal (State Bench or Area Benches),

by reason of a decision on such question of law.

7- At least 2 Judge bench to hear Appeal Where an appeal has been filed before the

High Court, it shall be heard by a Bench of not less than two Judges of the High Court,

and shall be decided in accordance with the opinion of such Judges or of the majority,

if any, of such Judges [Section 117(6) ]

8- Decision by majority or reference to Additional Judges Where there is no such

majority, the Judges shall state the point of law upon which they differ and the case

shall, then, be heard upon that point only, by one or more of the other Judges of the

High Court and such point shall be decided according to the opinion of the majority

of the Judges who have heard the case including those who first heard it [Section

117(7)]

9- Effect to be given to High Court Judgment Where the High Court delivers a

judgment in an appeal filed before it under this section, effect shall be given to such

judgment by either side on the basis of a certified copy of the judgment, [Section

117(8)]

10- Provisions of CPC TO Apply Save as otherwise provided in this Act, the provisions

of the Code of Civil procedure, 1908, relating to appeals to the High Court shall, as

far as may be, apply in the case of appeals under this section [Section 117(9)]

11- Pre-deposit of Tax Dues Pre-deposit of all tax dues is required to be made, otherwise

the inherent powers of the High Court have to be invoked for obtaining a stay pending

disposal of the appeal.

Que. 5 Appeal relating to place of supply matter- lies to Supreme Court: Mr. A had filed an

appeal before the Appellate Tribunal against an order of the Appellate Authority

where the issue involved related to place of supply. The order of Appellate Tribunal

is also in favour of the Department. Mr. A now wants to file an appeal against the

decision of the Appellate Authority as he feels the stand taken by him is correct.

you are required to advise him suitably with regard to filing of an appeal before the

Page304

appellate forum higher than the Appellate Tribunal (RTP May, 2018

Central Goods & Services Tax Act, 2017