Page 309 - CA Final GST

P. 309

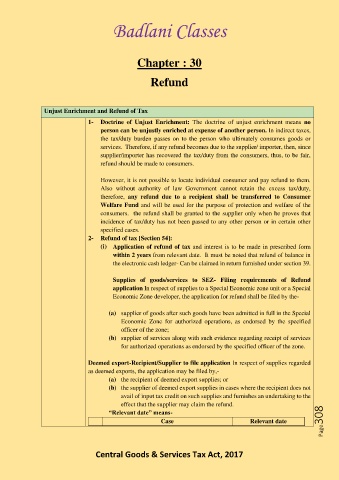

Badlani Classes

Chapter : 30

Refund

Unjust Enrichment and Refund of Tax

1- Doctrine of Unjust Enrichment: The doctrine of unjust enrichment means no

person can be unjustly enriched at expense of another person. In indirect taxes,

the tax/duty burden passes on to the person who ultimately consumes goods or

services. Therefore, if any refund becomes due to the supplier/ importer, then, since

supplier/importer has recovered the tax/duty from the consumers, thus, to be fair,

refund should be made to consumers.

However, it is not possible to locate individual consumer and pay refund to them.

Also without authority of law Government cannot retain the excess tax/duty,

therefore, any refund due to a recipient shall be transferred to Consumer

Welfare Fund and will be used for the purpose of protection and welfare of the

consumers. the refund shall be granted to the supplier only when he proves that

incidence of tax/duty has not been passed to any other person or in certain other

specified cases.

2- Refund of tax [Section 54]:

(i) Application of refund of tax and interest is to be made in prescribed form

within 2 years from relevant date. It must be noted that refund of balance in

the electronic cash ledger- Can be claimed in return furnished under section 39.

Supplies of goods/services to SEZ- Filing requirements of Refund

application In respect of supplies to a Special Economic zone unit or a Special

Economic Zone developer, the application for refund shall be filed by the-

(a) supplier of goods after such goods have been admitted in full in the Special

Economic Zone for authorized operations, as endorsed by the specified

officer of the zone;

(b) supplier of services along with such evidence regarding receipt of services

for authorized operations as endorsed by the specified officer of the zone.

Deemed export-Recipient/Supplier to file application In respect of supplies regarded

as deemed exports, the application may be filed by,-

(a) the recipient of deemed export supplies; or

(b) the supplier of deemed export supplies in cases where the recipient does not

avail of input tax credit on such supplies and furnishes an undertaking to the

effect that the supplier may claim the refund.

Page308

“Relevant date” means-

Case Relevant date

Central Goods & Services Tax Act, 2017