Page 312 - CA Final GST

P. 312

Badlani Classes

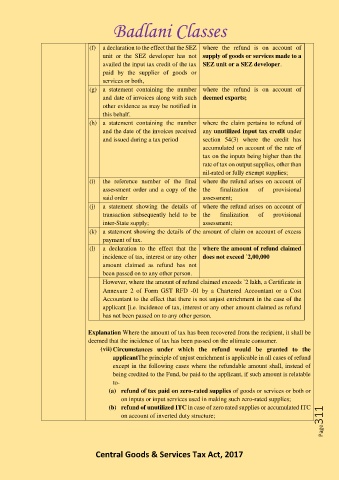

(f) a declaration to the effect that the SEZ where the refund is on account of

unit or the SEZ developer has not supply of goods or services made to a

availed the input tax credit of the tax SEZ unit or a SEZ developer.

paid by the supplier of goods or

services or both,

(g) a statement containing the number where the refund is on account of

and date of invoices along with such deemed exports;

other evidence as may be notified in

this behalf.

(h) a statement containing the number where the claim pertains to refund of

and the date of the invoices received any unutilized input tax credit under

and issued during a tax period section 54(3) where the credit has

accumulated on account of the rate of

tax on the inputs being higher than the

rate of tax on output supplies, other than

nil-rated or fully exempt supplies;

(i) the reference number of the final where the refund arises on account of

assessment order and a copy of the the finalization of provisional

said order assessment;

(j) a statement showing the details of where the refund arises on account of

transaction subsequently held to be the finalization of provisional

inter-State supply; assessment;

(k) a statement showing the details of the amount of claim on account of excess

payment of tax.

(l) a declaration to the effect that the where the amount of refund claimed

incidence of tax, interest or any other does not exceed `2,00,000

amount claimed as refund has not

been passed on to any other person.

However, where the amount of refund claimed exceeds `2 lakh, a Certificate in

Annexure 2 of Form GST RFD -01 by a Chartered Accountant or a Cost

Accountant to the effect that there is not unjust enrichment in the case of the

applicant [i.e. incidence of tax, interest or any other amount claimed as refund

has not been passed on to any other person.

Explanation Where the amount of tax has been recovered from the recipient, it shall be

deemed that the incidence of tax has been passed on the ultimate consumer.

(vii) Circumstances under which the refund would be granted to the

applicantThe principle of unjust enrichment is applicable in all cases of refund

except in the following cases where the refundable amount shall, instead of

being credited to the Fund, be paid to the applicant, if such amount is relatable

to-

(a) refund of tax paid on zero-rated supplies of goods or services or both or

on inputs or input services used in making such zero-rated supplies;

Page311

(b) refund of unutilized ITC in case of zero rated supplies or accumulated ITC

on account of inverted duty structure;

Central Goods & Services Tax Act, 2017