Page 317 - CA Final GST

P. 317

Badlani Classes

Utilization of Fund [Section 58]: All sums credited to the Fund shall be utilized by the

Government for the welfare of the consumers in such manner as may be prescribed. The

government or the authority specified by it shall maintain proper and separate account

and other relevant records in relation to the Fund and prepare an annual statement of

accounts in such form as may be prescribed in consultation with the Comptroller and

Auditor-General of India.

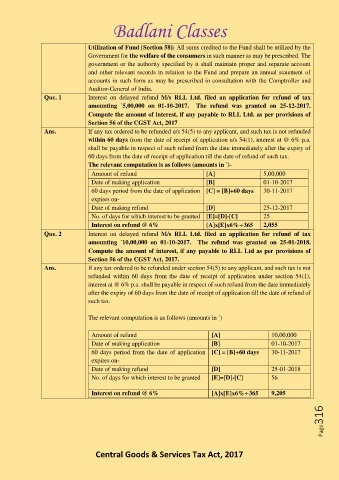

Que. 1 Interest on delayed refund M/s RLL Ltd. filed an application for refund of tax

amounting `5,00,000 on 01-10-2017. The refund was granted on 25-12-2017.

Compute the amount of interest, if any payable to RLL Ltd. as per provisions of

Section 56 of the CGST Act, 2017

Ans. If any tax ordered to be refunded u/s 54(5) to any applicant, and such tax is not refunded

within 60 days from the date of receipt of application u/s 54(1), interest at @ 6% p.a.

shall be payable in respect of such refund from the date immediately after the expiry of

60 days from the date of receipt of application till the date of refund of such tax.

The relevant computation is as follows (amounts in `)-

Amount of refund [A] 5,00,000

Date of making application [B] 01-10-2017

60 days period from the date of application [C] = [B]+60 days 30-11-2017

expires on-

Date of making refund [D] 25-12-2017

No. of days for which interest to be granted [E]=[D]-[C] 25

Interest on refund @ 6% [A]x[E]x6%÷365 2,055

Que. 2 Interest on delayed refund M/s RLL Ltd. filed an application for refund of tax

amounting `10,00,000 on 01-10-2017. The refund was granted on 25-01-2018.

Compute the amount of interest, if any payable to RLL Ltd as per provisions of

Section 56 of the CGST Act, 2017.

Ans. If any tax ordered to be refunded under section 54(5) to any applicant, and such tax is not

refunded within 60 days from the date of receipt of application under section 54(1),

interest at @ 6% p.a. shall be payable in respect of such refund from the date immediately

after the expiry of 60 days from the date of receipt of application till the date of refund of

such tax.

The relevant computation is as follows (amounts in `)

Amount of refund [A] 10,00,000

Date of making application [B] 01-10-2017

60 days period from the date of application [C] = [B]+60 days 30-11-2017

expires on-

Date of making refund [D] 25-01-2018

No. of days for which interest to be granted [E]=[D]-[C] 56

Interest on refund @ 6% [A]x[E]x6%÷365 9,205

Page316

Central Goods & Services Tax Act, 2017