Page 316 - CA Final GST

P. 316

Badlani Classes

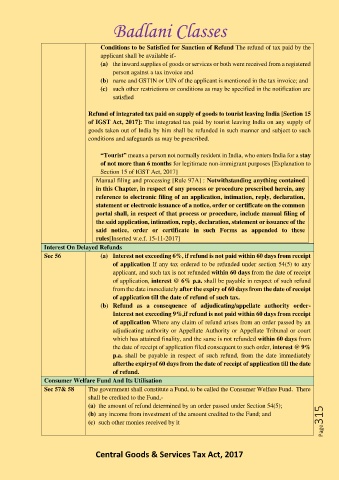

Conditions to be Satisfied for Sanction of Refund The refund of tax paid by the

applicant shall be available if-

(a) the inward supplies of goods or services or both were received from a registered

person against a tax invoice and

(b) name and GSTIN or UIN of the applicant is mentioned in the tax invoice; and

(c) such other restrictions or conditions as may be specified in the notification are

satisfied

Refund of integrated tax paid on supply of goods to tourist leaving India [Section 15

of IGST Act, 2017]: The integrated tax paid by tourist leaving India on any supply of

goods taken out of India by him shall be refunded in such manner and subject to such

conditions and safeguards as may be prescribed.

“Tourist” means a person not normally resident in India, who enters India for a stay

of not more than 6 months for legitimate non-immigrant purposes [Explanation to

Section 15 of IGST Act, 2017]

Manual filing and processing [Rule 97A] : Notwithstanding anything contained

in this Chapter, in respect of any process or procedure prescribed herein, any

reference to electronic filing of an application, intimation, reply, declaration,

statement or electronic issuance of a notice, order or certificate on the common

portal shall, in respect of that process or procedure, include manual filing of

the said application, intimation, reply, declaration, statement or issuance of the

said notice, order or certificate in such Forms as appended to these

rules[Inserted w.e.f. 15-11-2017]

Interest On Delayed Refunds

Sec 56 (a) Interest not exceeding 6%, if refund is not paid within 60 days from receipt

of application If any tax ordered to be refunded under section 54(5) to any

applicant, and such tax is not refunded within 60 days from the date of receipt

of application, interest @ 6% p.a. shall be payable in respect of such refund

from the date immediately after the expiry of 60 days from the date of receipt

of application till the date of refund of such tax.

(b) Refund as a consequence of adjudicating/appellate authority order-

Interest not exceeding 9%,if refund is not paid within 60 days from receipt

of application Where any claim of refund arises from an order passed by an

adjudicating authority or Appellate Authority or Appellate Tribunal or court

which has attained finality, and the same is not refunded within 60 days from

the date of receipt of application filed consequent to such order, interest @ 9%

p.a. shall be payable in respect of such refund, from the date immediately

afterthe expiryof 60 days from the date of receipt of application till the date

of refund.

Consumer Welfare Fund And Its Utilisation

Sec 57& 58 The government shall constitute a Fund, to be called the Consumer Welfare Fund. There

shall be credited to the Fund,-

(a) the amount of refund determined by an order passed under Section 54(5);

(b) any income from investment of the amount credited to the Fund; and

(c) such other monies received by it Page315

Central Goods & Services Tax Act, 2017