Page 311 - CA Final GST

P. 311

Badlani Classes

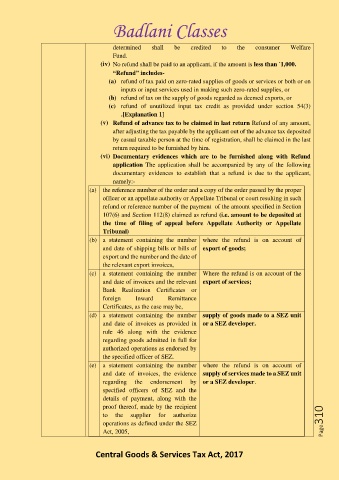

determined shall be credited to the consumer Welfare

Fund.

(iv) No refund shall be paid to an applicant, if the amount is less than `1,000.

“Refund” includes-

(a) refund of tax paid on zero-rated supplies of goods or services or both or on

inputs or input services used in making such zero-rated supplies, or

(b) refund of tax on the supply of goods regarded as deemed exports, or

(c) refund of unutilized input tax credit as provided under section 54(3)

.[Explanation 1]

(v) Refund of advance tax to be claimed in last return Refund of any amount,

after adjusting the tax payable by the applicant out of the advance tax deposited

by casual taxable person at the time of registration, shall be claimed in the last

return required to be furnished by him.

(vi) Documentary evidences which are to be furnished along with Refund

application The application shall be accompanied by any of the following

documentary evidences to establish that a refund is due to the applicant,

namely:-

(a) the reference number of the order and a copy of the order passed by the proper

officer or an appellate authority or Appellate Tribunal or court resulting in such

refund or reference number of the payment of the amount specified in Section

107(6) and Section 112(8) claimed as refund (i.e. amount to be deposited at

the time of filing of appeal before Appellate Authority or Appellate

Tribunal)

(b) a statement containing the number where the refund is on account of

and date of shipping bills or bills of export of goods;

export and the number and the date of

the relevant export invoices,

(c) a statement containing the number Where the refund is on account of the

and date of invoices and the relevant export of services;

Bank Realization Certificates or

foreign Inward Remittance

Certificates, as the case may be,

(d) a statement containing the number supply of goods made to a SEZ unit

and date of invoices as provided in or a SEZ developer.

rule 46 along with the evidence

regarding goods admitted in full for

authorized operations as endorsed by

the specified officer of SEZ.

(e) a statement containing the number where the refund is on account of

and date of invoices, the evidence supply of services made to a SEZ unit

regarding the endorsement by or a SEZ developer.

specified officers of SEZ and the

details of payment, along with the

proof thereof, made by the recipient

to the supplier for authorize

operations as defined under the SEZ Page310

Act, 2005,

Central Goods & Services Tax Act, 2017