Page 310 - CA Final GST

P. 310

Badlani Classes

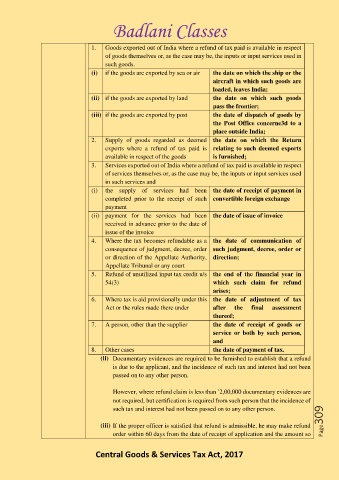

1. Goods exported out of India where a refund of tax paid is available in respect

of goods themselves or, as the case may be, the inputs or input services used in

such goods.

(i) if the goods are exported by sea or air the date on which the ship or the

aircraft in which such goods are

loaded, leaves India;

(ii) if the goods are exported by land the date on which such goods

pass the frontier;

(iii) if the goods are exported by post the date of dispatch of goods by

the Post Office concerne3d to a

place outside India;

2. Supply of goods regarded as deemed the date on which the Return

exports where a refund of tax paid is relating to such deemed exports

available in respect of the goods is furnished;

3. Services exported out of India where a refund of tax paid is available in respect

of services themselves or, as the case may be, the inputs or input services used

in such services and

(i) the supply of services had been the date of receipt of payment in

completed prior to the receipt of such convertible foreign exchange

payment

(ii) payment for the services had been the date of issue of invoice

received in advance prior to the date of

issue of the invoice

4. Where the tax becomes refundable as a the date of communication of

consequence of judgment, decree, order such judgment, decree, order or

or direction of the Appellate Authority, direction;

Appellate Tribunal or any court

5. Refund of unutilized input tax credit u/s the end of the financial year in

54(3) which such claim for refund

arises;

6. Where tax is aid provisionally under this the date of adjustment of tax

Act or the rules made there under after the final assessment

thereof;

7. A person, other than the supplier the date of receipt of goods or

service or both by such person,

and

8. Other cases the date of payment of tax.

(ii) Documentary evidences are required to be furnished to establish that a refund

is due to the applicant, and the incidence of such tax and interest had not been

passed on to any other person.

However, where refund claim is less than `2,00,000 documentary evidences are

not required, but certification is required from such person that the incidence of

such tax and interest had not been passed on to any other person.

Page309

(iii) If the proper officer is satisfied that refund is admissible, he may make refund

order within 60 days from the date of receipt of application and the amount so

Central Goods & Services Tax Act, 2017