Page 85 - CA Final GST

P. 85

Badlani Classes

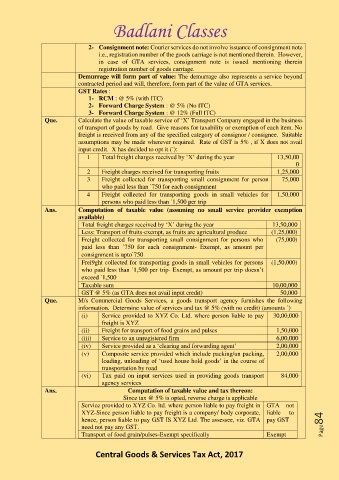

2- Consignment note: Courier services do not involve issuance of consignment note

i.e., registration number of the goods carriage is not mentioned therein. However,

in case of GTA services, consignment note is issued mentioning therein

registration number of goods carriage.

Demurrage will form part of value: The demurrage also represents a service beyond

contracted period and will, therefore, form part of the value of GTA services.

GST Rates :

1- RCM : @ 5% (with ITC)

2- Forward Charge System : @ 5% (No ITC)

3- Forward Charge System : @ 12% (Full ITC)

Que. Calculate the value of taxable service of ‘X’ Transport Company engaged in the business

of transport of goods by road. Give reasons for taxability or exemption of each item. No

freight is received from any of the specified category of consignor / consignee. Suitable

assumptions may be made wherever required. Rate of GST is 5% , if X does not avail

input credit. X has decided to opt it (`):

1 Total freight charges received by ‘X’ during the year 13,50,00

0

2 Freight charges received for transporting fruits 1,25,000

3 Freight collected for transporting small consignment for person 75,000

who paid less than `750 for each consignment

4 Freight collected for transporting goods in small vehicles for 1,50,000

persons who paid less than `1,500 per trip

Ans. Computation of taxable value (assuming no small service provider exemption

available)

Total freight charges received by ‘X’ during the year 13,50,000

Less: Transport of fruits-exempt, as fruits are agricultural produce (1,25,000)

Freight collected for transporting small consignment for persons who (75,000)

paid less than `750 for each consignment- Exempt, as amount per

consignment is upto`750

Frei9ght collected for transporting goods in small vehicles for persons (1,50,000)

who paid less than `1,500 per trip- Exempt, as amount per trip doesn’t

exceed `1,500

Taxable sum 10,00,000

GST @ 5% (as GTA does not avail input credit) 50,000

Que. M/s Commercial Goods Services, a goods transport agency furnishes the following

information. Determine value of services and tax @ 5% (with no credit) (amounts `)

(i) Service provided to XYZ Co. Ltd. where person liable to pay 30,00,000

freight is XYZ

(ii) Freight for transport of food grains and pulses 1,50,000

(iii) Service to an unregistered firm 6,00,000

(iv) Service provided as a ‘clearing and forwarding agent’ 2,00,000

(v) Composite service provided which include packing/un packing, 2,00,000

loading, unloading of ‘used house hold goods’ in the course of

transportation by road

(vi) Tax paid on input services used in providing goods transport 84,000

agency services

Ans. Computation of taxable value and tax thereon:

Since tax @ 5% is opted, reverse charge is applicable

Service provided to XYZ Co. ltd. where person liable to pay freight in GTA not

XYZ-Since person liable to pay freight is a company/ body corporate, liable to

hence, person liable to pay GST IS XYZ Ltd. The assessee, viz. GTA pay GST Page84

need not pay any GST.

Transport of food grain/pulses-Exempt specifically Exempt

Central Goods & Services Tax Act, 2017