Page 14 - Phelan Energy Green Ammonia Plant Egypt

P. 14

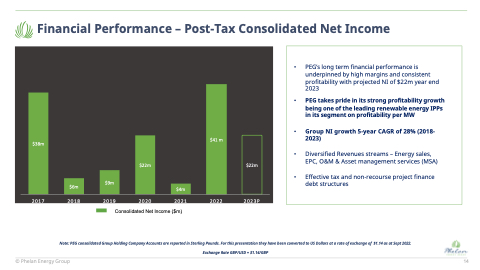

Financial Performance – Post-Tax Consolidated Net Income

• PEG’s long term financial performance is underpinned by high margins and consistent profitability with projected NI of $22m year end 2023

• PEG takes pride in its strong profitability growth being one of the leading renewable energy IPPs in its segment on profitability per MW

• Group NI growth 5-year CAGR of 28% (2018- 2023)

• Diversified Revenues streams – Energy sales, EPC, O&M & Asset management services (MSA)

• Effective tax and non-recourse project finance debt structures

$38m

$6m

$9m

$22m

$4m

$41 m

$22m

2017 2018 2019 2020 2021 2022 2023P

Consolidated Net Income ($m)

Note: PEG consolidated Group Holding Company Accounts are reported in Sterling Pounds. For this presentation they have been converted to US Dollars at a rate of exchange of $1.14 as at Sept 2022. Exchange Rate GBP/USD = $1.14/GBP

© Phelan Energy Group

14