Page 13 - Phelan Energy Green Ammonia Plant Egypt

P. 13

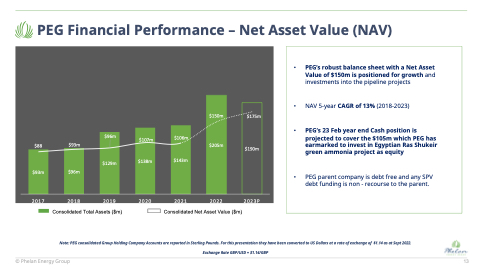

PEG Financial Performance – Net Asset Value (NAV)

• PEG’s robust balance sheet with a Net Asset Value of $150m is positioned for growth and investments into the pipeline projects

• NAV 5-year CAGR of 13% (2018-2023)

• PEG’s 23 Feb year end Cash position is projected to cover the $105m which PEG has

earmarked to invest in Egyptian Ras Shukeir green ammonia project as equity

• PEG parent company is debt free and any SPV debt funding is non - recourse to the parent.

$88

$93m

$93m

$96m

$96m

$129m

$107m $138m

$106m $143m

$150m

$205m

$175m

$190m

2017 2018 2019 2020 2021 2022 2023P

Consolidated Total Assets ($m) Consolidated Net Asset Value ($m)

Note: PEG consolidated Group Holding Company Accounts are reported in Sterling Pounds. For this presentation they have been converted to US Dollars at a rate of exchange of $1.14 as at Sept 2022. Exchange Rate GBP/USD = $1.14/GBP

© Phelan Energy Group

13