Page 133 - FlipBook BACK FROM SARAN - MAY 5 2020 - Don't Make Me Say I Told You So_6.14x9.21_v9_Neat

P. 133

Don’t Make Me Say I Told You So 119

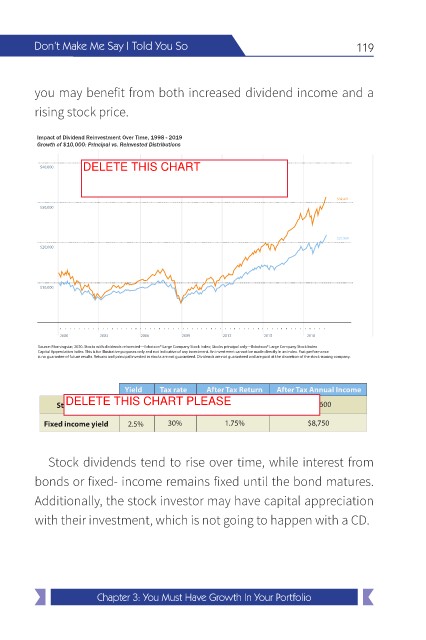

you may benefit from both increased dividend income and a

rising stock price.

Impact of Dividend Reinvestment Over Time, 1998 - 2019

Growth of $10,000: Principal vs. Reinvested Distributions

$40,000 DELETE THIS CHART

Stocks, Principal Only

Stocks, Dividends Only

$32,421

$30,000

$21,989

$20,000

$10,000

2000 2003 2006 2009 2012 2015 2018

Source: Morningstar, 2020. Stocks with dividends reinvested—Ibbotson® Large Company Stock Index; Stocks principal only—Ibbotson® Large Company Stock Index

Capital Appreciation Index. This is for illustrative purposes only and not indicative of any investment. An investment cannot be made directly in an index. Past performance

is no guarantee of future results. Returns and principal invested in stocks are not guaranteed. Dividends are not guaranteed and are paid at the discretion of the stock-issuing company.

Yield Tax rate After Tax Return After Tax Annual Income

DELETE THIS CHART PLEASE

Stock dividend 2.5% 15% 2.12% $10,600

Fixed income yield 2.5% 30% 1.75% $8,750

Stock dividends tend to rise over time, while interest from

bonds or fixed- income remains fixed until the bond matures.

Additionally, the stock investor may have capital appreciation

with their investment, which is not going to happen with a CD.

Chapter 3: You Must Have Growth In Your Portfolio