Page 280 - FlipBook BACK FROM SARAN - MAY 5 2020 - Don't Make Me Say I Told You So_6.14x9.21_v9_Neat

P. 280

266 Don’t Make Me Say I Told You So

Gifting

There is an opportunity to pass assets from your taxable estate

to your children or grandchildren, by making gifts to them

from your current assets. Presently, you can gift up to $15,000

annually ($30,000 for joint gifts with your spouse) to as many

people as you like without having to file an IRS gift tax Form 709.

Of course, these amounts may change in the future.

Gifting can provide savings or investment accounts for the

recipient and tax benefits for the gift-giver. Gifts remove assets

that may be subject to estate taxes, and such asset gifts are

not limited to children. You may also gift up to $15,000 a year

to as many people as you like in the form of cash, property, or

investments.

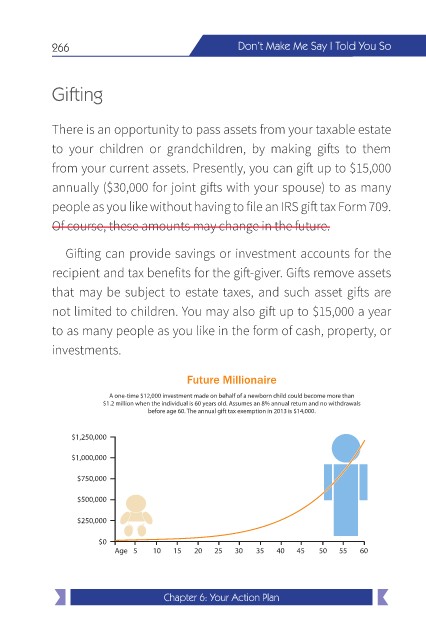

Future Millionaire

A one-time $12,000 investment made on behalf of a newborn child could become more than

$1.2 million when the individual is 60 years old. Assumes an 8% annual return and no withdrawals

before age 60. The annual gift tax exemption in 2013 is $14,000.

$1,250,000

$1,000,000

$750,000

$500,000

$250,000

$0

Age 5 10 15 20 25 30 35 40 45 50 55 60

Chapter 6: Your Action Plan