Page 27 - Agib Bank Ltd Annual Report and IFRS Financial statements 2020

P. 27

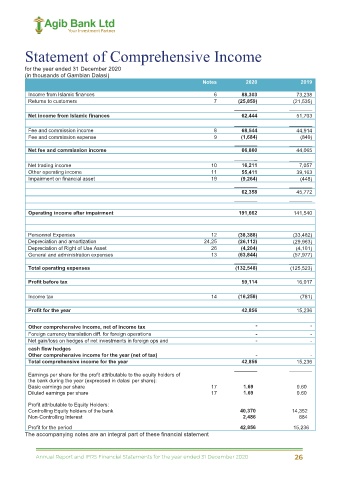

Statement of Comprehensive Income

for the year ended 31 December 2020

(in thousands of Gambian Dalasi)

Notes 2020 2019

Income from Islamic finances 6 88,303 73,238

Returns to customers 7 (25,859) (21,535)

________ ________

Net income from Islamic finances 62,444 51,703

________ ________

Fee and commission income 8 68,544 44,914

Fee and commission expense 9 (1,684) (849)

________ ________

Net fee and commission income 66,860 44,065

________ ________

Net trading income 10 16,211 7,057

Other operating income 11 55,411 39,163

Impairment on financial asset 19 (9,264) (448)

________ ________

62,358 45,772

________ ________

Operating income after impairment 191,662 141,540

Personnel Expenses 12 (38,388) (33,482)

Depreciation and amortization 24,25 (26,112) (29,963)

Depreciation of Right of Use Asset 26 (4,204) (4,101)

General and administration expenses 13 (63,844) (57,977)

________ ________

Total operating expenses (132,548) (125,523)

Profit before tax 59,114 16,017

Income tax 14 (16,258) (781)

Profit for the year 42,856 15,236

Other comprehensive income, net of income tax - -

Foreign currency translation diff. for foreign operations - -

Net gain/loss on hedges of net investments in foreign ops and - -

cash flow hedges

Other comprehensive income for the year (net of tax) - -

Total comprehensive income for the year 42,856 15,236

________ ________

Earnings per share for the profit attributable to the equity holders of

the bank during the year (expressed in dalasi per share):

Basic earnings per share 17 1.69 0.60

Diluted earnings per share 17 1.69 0.60

Profit attributable to Equity Holders:

Controlling Equity holders of the bank 40,370 14,352

Non-Controlling Interest 2,486 884

Profit for the period 42,856 15,236

The accompanying notes are an integral part of these financial statement

Annual Report and IFRS Financial Statements for the year ended 31 December 2020 26