Page 80 - Agib Bank Ltd Annual Report and IFRS Financial statements 2020

P. 80

Money Gram, 639 675 Payable Income Tax 484 494

Qodoo Float 455 2,457 Fringe Benefit Payable 1,188

Sundry Debtors - 479 VAT Payable 781

IDB Facility Admin and Legal - 337 Accrued Finance Cost iro IDB Facility - 1,035

Sale of Property 7,077 - Liability for Litigation against the bank 1,500 1,500

Total other assets 15,277 14,607 IDB Credit Line - 100,700

70,920 136,610

29 Deposits from customers

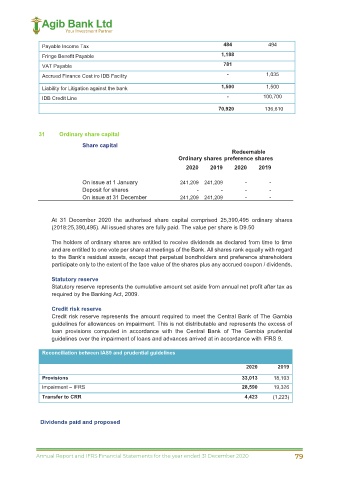

31 Ordinary share capital

2020 2019

Share capital

Current and demand accounts 972,714 365,494 Redeemable

Savings account 1,254,694 1,002,168 Ordinary shares preference shares

Bankers acceptances - - 2020 2019 2020 2019

Investment Accounts: On issue at 1 January 241,209 241,209 - -

Deposit for shares - - - -

3 Months 9,094 10,949

On issue at 31 December 241,209 241,209 - -

6 Months 6,306 3,635

12 Months 239,925 227,221

At 31 December 2020 the authorised share capital comprised 25,390,495 ordinary shares

Total deposits from customers 2,482,733 1,609,467 (2018:25,390,495). All issued shares are fully paid. The value per share is D9.50

The holders of ordinary shares are entitled to receive dividends as declared from time to time

30 Other liabilities and are entitled to one vote per share at meetings of the Bank. All shares rank equally with regard

to the Bank’s residual assets, except that perpetual bondholders and preference shareholders

2020 2019

participate only to the extent of the face value of the shares plus any accrued coupon / dividends.

Other liabilities

Statutory reserve

Accrued Other Expenses 3,016 Statutory reserve represents the cumulative amount set aside from annual net profit after tax as

Provision for Bonus payment 2,381 - required by the Banking Act, 2009.

Accrued Software Cost 5,250 -

Deferred Fixed Mudaraba 12,537 13,337 Credit risk reserve

Credit risk reserve represents the amount required to meet the Central Bank of The Gambia

Dividend Payable 6,884 8,384 guidelines for allowances on impairment. This is not distributable and represents the excess of

Other Payables 3,616 44 loan provisions computed in accordance with the Central Bank of The Gambia prudential

Payable Remittance 23,152 10,776 guidelines over the impairment of loans and advances arrived at in accordance with IFRS 9.

Payable Social Security 335 340 Reconciliation between IAS9 and prudential guidelines

Accrued Medical 652 - 2020 2019

Cleaning Expense 341 -

Path Annual Maintenance 2,440 - Provisions 33,013 18,103

RIA Express 1,712 Impairment – IFRS 28,590 19,326

Western Union 2,504 Transfer to CRR 4,423 (1,223)

Small World Money Transfer 708

Moneygram 484 Dividends paid and proposed

Accrued Rent 955

64 65

Annual Report and IFRS Financial Statements for the year ended 31 December 2020 79