Page 81 - Agib Bank Ltd Annual Report and IFRS Financial statements 2020

P. 81

The Directors are proposing for the payment of D0.50 per share as dividend for the year ended

31 December 2020.

For the year ended 31 December 2019, the shareholders approved and paid a cash dividend of D0.43

per share (D10.918million) at the Annual General Meeting held on 08 September 2020.

th

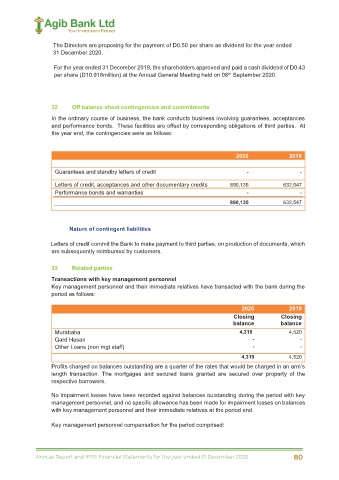

32 Off balance sheet contingencies and commitments

In the ordinary course of business, the bank conducts business involving guarantees, acceptances

and performance bonds. These facilities are offset by corresponding obligations of third parties. At

the year end, the contingencies were as follows:

2020 2019

Guarantees and standby letters of credit - -

Letters of credit, acceptances and other documentary credits 890,135 632,547

Performance bonds and warranties - -

890,135 632,547

Nature of contingent liabilities

Letters of credit commit the Bank to make payment to third parties, on production of documents, which

are subsequently reimbursed by customers.

33 Related parties

Transactions with key management personnel

Key management personnel and their immediate relatives have transacted with the bank during the

period as follows:

2020 2019

Closing Closing

balance balance

Murabaha 4,319 4,520

Qard Hasan - -

Other Loans (non mgt staff) - -

4,319 4,520

Profits charged on balances outstanding are a quarter of the rates that would be charged in an arm’s

length transaction. The mortgages and secured loans granted are secured over property of the

respective borrowers.

No impairment losses have been recorded against balances outstanding during the period with key

management personnel, and no specific allowance has been made for impairment losses on balances

with key management personnel and their immediate relatives at the period end.

Key management personnel compensation for the period comprised:

66

Annual Report and IFRS Financial Statements for the year ended 31 December 2020 80